Do your Finances Need a Checkup?

Financial Health and You

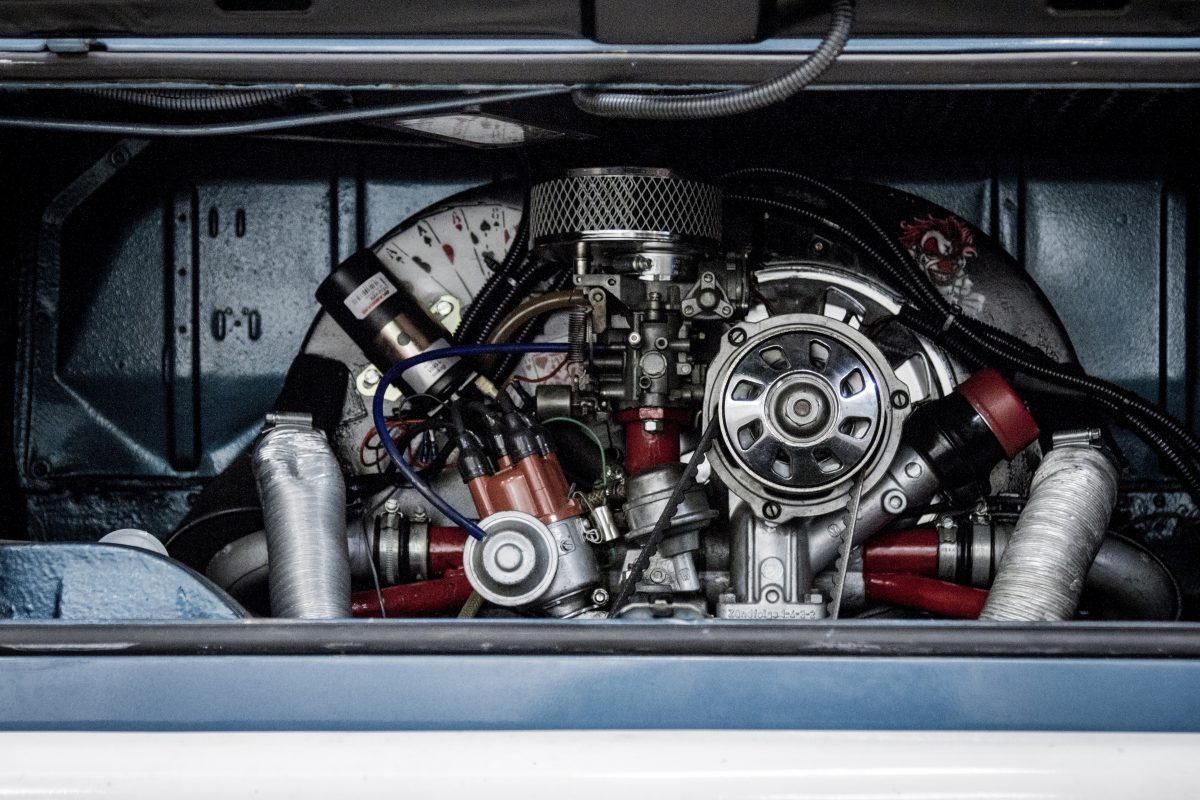

When is the last time you went to the doctor for a checkup? You probably went at least once last year, and maybe you’ve gone sometime this year, as well. It’s important to have regular checkups; whether it’s your body, your car, or your family. Unfortunately, there is another vital check-up that most federal employees can’t remember doing: a financial checkup. Your financial health is one of the most vital parts of your life, and you should take every chance to check these nine things.

1) Are you taking full advantage of your TSP?

Federal employees can take advantage of retirement savings plans like the Thrift Savings Plan, which offers several excellent benefits, such as a match in contributions up to a certain percentage and the ability to invest in a wide variety of funds with more or less conservative growth and risk.

2) Are you investing in the TSP appropriately?

Before you invest entirely in the TSP, make sure you fully understand the best way to invest to get the most out of your agency’s contribution matches. Be sure to talk to a TSP expert before you make any vital decision.

3) Are you Missing Out on Better Federal Employees Health Benefit Opportunities?

Whenever you make a significant life change, you should check to see if there is anything that could change about your FEHB. Whether it’s retirement, a new child, or marriage, there is a chance that you could be getting a better rate. Be sure to take advantage of this year’sFEHB open season to learn how you could save your money.

4) Are you ignoring the alternatives?

FEGLI is not the only life insurance provider on the market. Make sure that you are looking for better life insurance deals before you commit to FEGLI since your financial health could be at stake.

5) Are you overestimating your H3?

Your H3, your three highest-income years before retirement, may be subject to change in the coming years if you are looking to get a raise in the years to come. Be sure that you have a reasonable understanding of how your finances will change in the future.

6) Are you likely to miss out on creditable service time?

In calculating your retirement annuity, service time is one of the most critical aspects of how much you will earn on your investments. Be sure all your working time can accumulate service credit.

7) Are you overestimating your Social Security benefits?

Social Security can be an intricate process to understand without the help of a professional. It’s based on a complicated formula that is subject to adjustment based on wage growth, so it is too easy to overestimate how much you will be receiving.

8) Do you want the Survivor Benefit?

If you are married, you should make a decision now regarding how you want to handle your survivor’s benefit. Do you want a full benefit, partial benefit, or to reject the survivor annuity wholesale and put the money into alternative investments?

9) Are your beneficiary designations up to date?

Make sure you know who your money is going to- it saves time and avoids complications when it comes to redeeming claims.

Use these 9 tips next time you talk to your financial advisor and make sure your financial health is acceptable for your future.