TSP Loses ‘Low Expense’ Lead

As we all know, one of the biggest benefits of having the government’s Thrift Savings Plan (TSP) is the low expenses attached. Compared to other investment funds, the TSP has long had a reputation for low expenses…but this is now changing.

As with most industries these days, competition is increasing, and August welcomed two Fidelity funds with no expense fees (as well as Fidelity reducing fees across other products). What’s more, the new ZERO Total Market Index Fund (FZROX) aims to provide a return similar to a range of US stocks; a much wider target than the TSP C Fund which concentrates solely on the S&P 500 Index.

Meanwhile, the ZERO International Index Fund (FZILX) is similar to the I Fund in that it aims to correspond to foreign developed and emerging stock markets. Although they both focus on stocks, and therefore this isn’t direct competition to the TSP, it still shows that the market is evolving and competition increasing.

Elsewhere at Fidelity, broader investment options are available with commission-free ETFs in addition to commission-free iShares. Around 1,800 ETFs are also now free from commission at Vanguard, the largest provider of mutual funds in the market. With no commission and low expenses (no minimum or account fees), the product ranges of Vanguard and Fidelity also include bond ETFs.

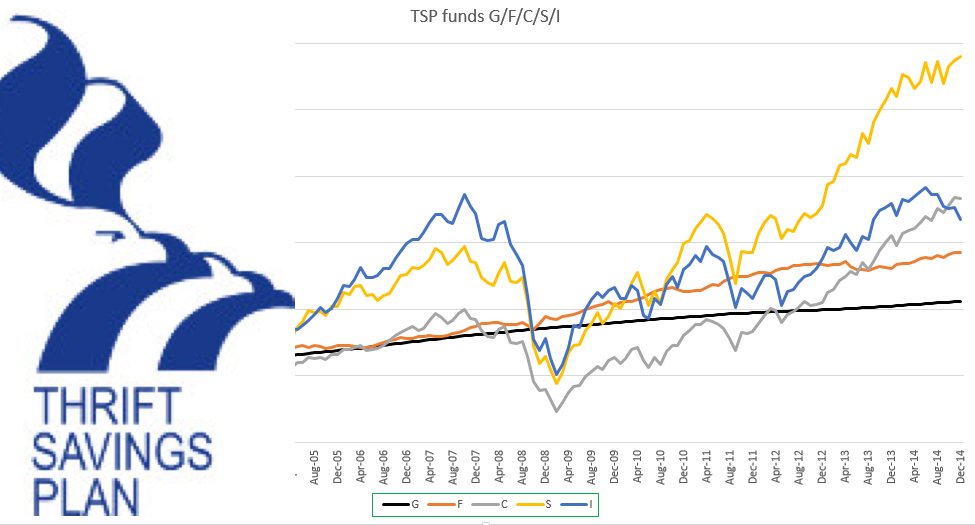

What About Returns?

Of course, we understand that paying no expenses means very little when the returns aren’t comparable. While the two new products from Fidelity don’t have enough experience for us to judge their performance, the Total Market Index Fund (FSTMX) gained around 16.36% between August 2017 and August 2018. For Vanguard, an even higher percentage (16.45%) was seen for their Total Stock Market ETF (VTI). For the TSP C Fund, the same rate sat at 16.21%.

What Does This Mean for TSP?

For current employees, it would be silly to walk away from a TSP when the government matches contributions. Remove this option, though, and the likes of Fidelity and Vanguard suddenly look more attractive. One saving grace for the TSP is the G Fund which removes the risk of a loss of principal and can provide rates comparable to 10-year Treasury notes.

For example, US Treasury bonds (maturities remaining of around 7-10 years) are tracked by the iShares 7-10 Year Treasury Bond ETF (IEF). While this has seen a loss of nearly 2% across the last 12 months, the G Fund has provided a return of 2.59%. While no changes are planned by Congress for the G Fund, it’ll be one of the most attractive options for anyone with access to the TSP.

With pressure from Vanguard, Fidelity, and numerous other companies, this could lead to changes in the TSP in the coming months and years. Currently, the TSP has a trick or two still up its sleeve but it’s only a matter of time before these USPs disappear, and the ‘best’ options belong to someone else.

Summary

Ultimately, the decision you make for your future is completely up to you; choosing to follow friends and colleagues may be detrimental for your own financial state so assess your position carefully. For retired employees or anybody not taking advantage of matching contributions, now is the time to consider your options. Is TSP really still the best option?

If you’re soon coming across the Required Minimum Distribution (RMD) and having to withdraw from the TSP, there may be better low-cost (or even no-cost!) funds that provide a stronger solution. If you’re concerned or don’t want to make a mistake, feel free to contact a financial professional that can consider your financial situation as well as suggest possible solutions!