October 8, 2023 / by todd carmack

October 8, 2023 / by todd carmack

Even though it's one o...

September 26, 2023 / by joe carreno

September 26, 2023 / by joe carreno

Your IRA contributions are made to supplement your i...

September 26, 2023 / by todd carmack

September 26, 2023 / by todd carmack

People who think about retiring soon and early retirees will have to navigate rough waters during these periods. With the stock market in decline, the economy weakening, and the Federal Reserve signaling future interest rate rises to battle inflation, retirees...

September 21, 2023 / by marvin dutton

September 21, 2023 / by marvin dutton

A measure to change the retirement system for first responders who sustain injuries while on duty and must seek out new employment within the federal government was unanimously approved by the House on Tuesday. First responder federal ...

September 15, 2023 / by michael crowe

September 15, 2023 / by michael crowe

H.L. Mencken famously noted that the objective of politics is to keep the people alarmed (and hence clamorous to be brought to safety) by threatening them with an infinite series of fictitious hobgoblins. He was correct, and few things in...

September 9, 2023 / by michael crowe

September 9, 2023 / by michael crowe

It's common knowledge that it is crucial to hold various retirement investments that enable income generation. After all, Social Security may be forced to make benefit adjustments in the future, which could mean a lower monthly payout for you. Even...

September 8, 2023 / by todd carmack

September 8, 2023 / by todd carmack

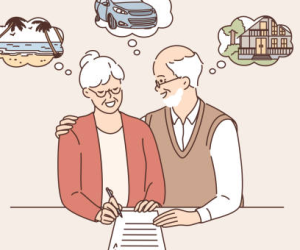

Federal employees can review and make changes to their health insur...

September 8, 2023 / by joe carreno

September 8, 2023 / by joe carreno

Could a defined-contribution retirement savings plan introduced in 1918 provide answers to one of the most perplexing 401(k) questions? ...

September 3, 2023 / by michael crowe

September 3, 2023 / by michael crowe

It shouldn't be a surprise that employees nearing retirement are more scared of inflation, per a recent survey by Schwab Workplace Financial Services®. Monthly costs (mentioned by 35% of participants) and stock market volatility (cited by 33% of participants) came...

August 15, 2023 / by jason anderson

August 15, 2023 / by jason anderson

What do a Las Vegas gambling trip and stock (or bond) market timing have in common? Frequently, the same thing. Most people at a casino or home watching Wall Street let their emotions rule. Peopl...

July 28, 2023 / by michael crowe

July 28, 2023 / by michael crowe

A magazine reporter on...

July 21, 2023 / by marvin dutton

July 21, 2023 / by marvin dutton

The primary reason we contribute to our Thrift Savings Plan account is so that we can begin withdrawing from it at some point in the future. In addition, most of us view our TSP balance as a source of monthly...

July 15, 2023 / by marvin dutton

July 15, 2023 / by marvin dutton

All TSP participants will need to create a new login for the new My Account after the transition in June. This one-time setup process will guide you throu...

July 14, 2023 / by joe carreno

July 14, 2023 / by joe carreno

OPM's lowest-cost countrywide plan choice will be automatically selected for you if you don't switch plans.The number of providers and their makeup under the Federal Employees Health Benefits program is changing more this year than in prior years. In light...

July 10, 2023 / by michael crowe

July 10, 2023 / by michael crowe

An annuity is one of several withdrawal arrangements available in the

July 9, 2023 / by marvin dutton

July 9, 2023 / by marvin dutton

Despite the necessity of focusing on day-to-day operational concerns, many firms need help to build a practical and realistic Technology Strategy. The inability to examine essential components of an IT strategy can have disastrous effects on a company's ability to...

June 6, 2023 / by Mitul Patel

June 6, 2023 / by Mitul Patel

When it comes to retirement, women face unique challenges. Women have a five-year advantage over males in terms of expected lifespan, yet they only earn 84 cents for every dollar their male coworkers bring in. Because of this, it's not...

June 6, 2023 / by Mitul Patel

June 6, 2023 / by Mitul Patel

The 8.7% cost-of-living adjustment (COLA) published earlier this month will result in a welcome increase in