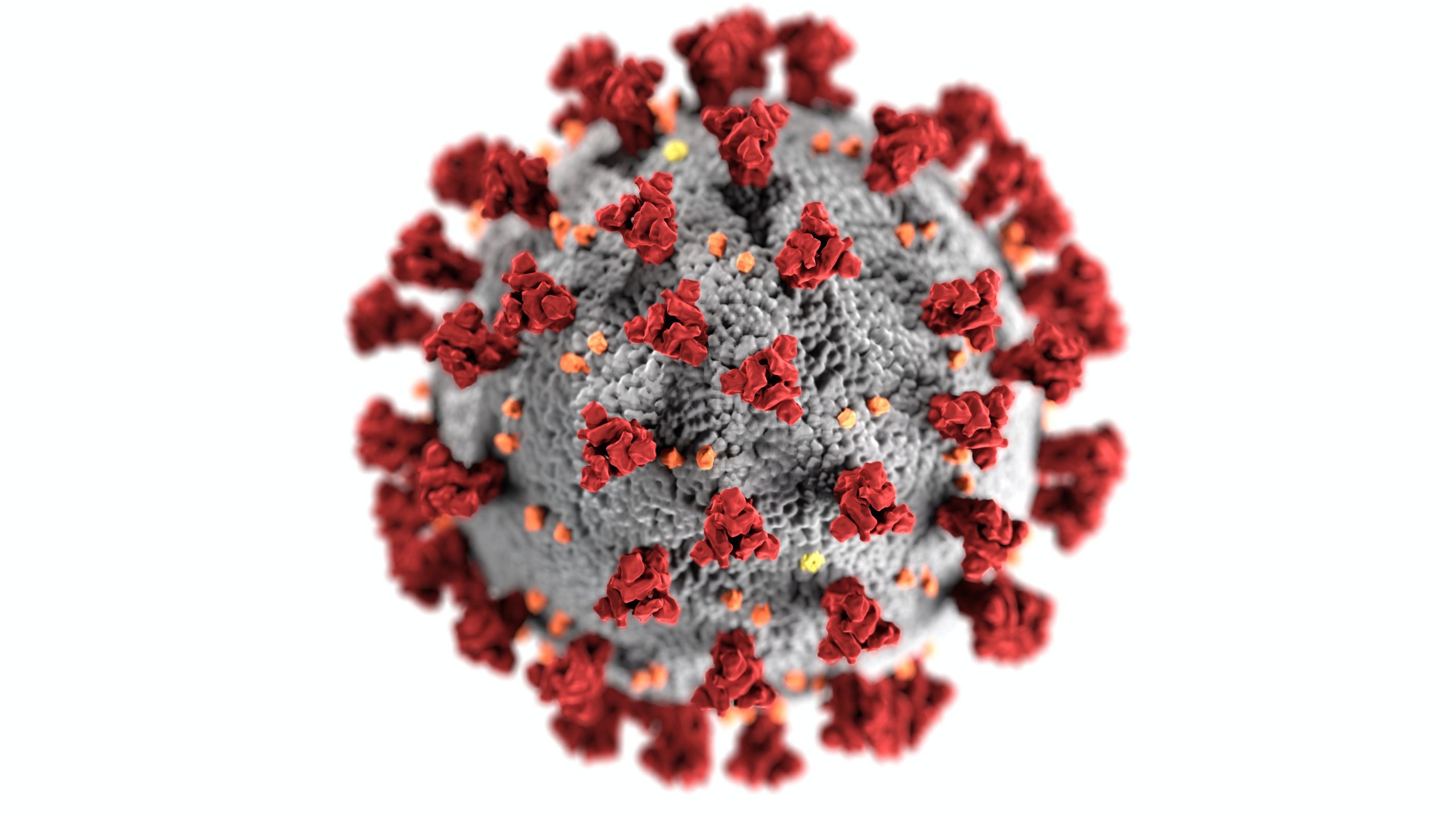

TSP Accounts: After the coronavirus has hit the world economy hard, how long is the road to recovery? By: Kathy Hollingsworth

The coronavirus has clobbered the world economy and the people depending on it. Some of the geniuses are working hard to find the vaccine and possible solutions for fighting this deadly virus, but until a controllable solution is available, the stock markets around the globe can fall at historical speeds. TSP account holders are amongst those hit worst by this virus and are now looking forward to recovering their losses due to the current market decline.

Many investors already know that this type of stock market decline is inevitable. The two main questions that bother our minds when such decline begins are: (1) How harsh will this decline be? (2) How long will it stay?

We can never predict when the stock market decline will happen, or why it happens. Sometimes, the U.S. or world equities never see a declining market, and sometimes they experience multiple declines. For example, in the year 1990, the decade started with a minor drop of over 10% that ended in January 1991, after a small period of recession and just after the collaboration of military operations in Iraq as part of Operation Desert Storm. The subsequent downturns were not seen until 1997 and 1998, and they were too short-lived and not very noticeable. Before that era, in 1987, the U.S. market saw the sharpest one-day drop of 22%. This was just three months before the C Fund came into operations. Soon a $250,000 portfolio was invested in the S&P 500 stock index fund (tracked by C Fund) after that; the day dropped to about $193,000 overnight. During that time, the stock markets declined by almost 1/3rd in totality.

Many investors experienced multiple downturns in 2020. Initially, it was seen in 2000 and continued for three years. Historically, this was the longest downturn followed by a historic bubble in stock market values – the S&P 500 and the C Fund returned at least 20% in each of the five prior years in the late 1990s in addition to the 9/11 terrorist attacks and a recession during that period. The next downturn was observed in 2008-9, and it was one of the worst drops in the U.S. and global stock markets since the Great Depression that started in 1929 and continued until the late 1930s.

From the stock market data of those years, we can analyze how an average investor would have dealt with stocks during those major declines and after the drop. Smart investors not only dealt with that traumatic period but also emerged as successful investors after surviving those downturns.

A recently released book titled, “TSP Investing Strategies: Building Wealth While Working for Uncle Sam, Second Edition” is a good one to analyze every 20-, 30-, 35-, and the 40-year period between 1900 and 2019, to find how average investors survived despite a variety of market declines during those timeframes. Each period has its own characteristics, but it is very important to check that investments in broad U.S. stock indexes (just like C and S Funds) dropped considerably at a certain point during every period that was analyzed, and they were also able to recover and raise enough after that decline. It was examined that in every 30-year period examined since 1900, an all-U.S. stock index portfolio (especially C Fund) outperformed the all-government bond portfolio (especially G Fund), by a noticeable margin. One exception was seen in the period from 1903 to 1932 when the market dropped evenly during the depths of the Depression (the stock fund was able to recover in the next couple of years).

If we know this in advance and analyze how an average investor deals with the market decline, and how they emerge as winners, then a person needs to be mentally prepared, if not emotionally, for the stock market drops as they happen.

Let’s understand this process. Start examining the 35-year period from January 1983 to December 2017. This period includes the sharp drop in 1987, the bubble years of the late 1990s, the longest drop in the U.S. stock market over three consecutive years in the early 2000s, and finally, the biggest decline in the U.S. equities of over 50% in 2008 and early 2009.

Let’s analyze this timeframe as a period for a new employee who contributes 5% of an entry-level salary of $30,000. According to government rules, this would make $250 in monthly contributions in the first year. Let’s assume that the annual salary and the regular contributions of this employee increase by 5% a year. Over 35 years, this employee would have a total contribution of about $271,000, and if we assume that half of this contribution matches the government’s, then that means a federal employee with a TSP account would have invested less than $136,000 of his or her money over the 35-year period.

To understand this clearly, four portfolios were tested. The first one is investing all contributions monthly in the S&P 500, representing the C Fund. The second one is investing all contributions monthly in an account that returns the 10-year U.S. Government Bond interest rate (closely equivalent to G Fund). A third one is investing about 65% in the S&P 500 and 35% in the 10-year bond, without any rebalancing. The fourth one is investing in the same percentage but rebalancing at the end of each year back to the same percentage (65-35) to account for portfolio drift over time.

Here, are the results of the four portfolios of investors who invested monthly from January 1983 to December 2017:

The highest value after investing for the 35-period is seen in the case of the C Fund; during each market drop, the fund also suffered a sharp drop in account value as compared to other funds. As compared to the balanced funds, it took a long time to recover after each decline, depending on our definition of “recover.”

If we define “recover” as the time starting from the month of peak value before the drop took place to the month when the value surpassed that same value, then we can say that all-C Fund account portfolios took five years to recover their losses after the 3-year decline of the early 2000s, and the 65-35 C-G Fund took just four years while the 65-35 annually rebalanced account took 3½ years to recover losses.

During 2008-9, the market decline was for a short duration, but it was sharper where all-C Fund account portfolio took three years to recover, the 65-35 account took three years, and the annually rebalanced 65-35 account took only 29 months to recover.

This thing may not be visible in the chart, but we can clearly see that the fastest recovery during this period came after the major market declines in the late-1987 period. All-C Fund account portfolios recovered to their original value in a year, and the other funds recovered faster than C Funds. The main reason was U.S. equities that recovered relatively quickly despite the market drop of about one-third.

Well, we must say that the 10-Year Government Bond account never declined despite the coronavirus market decline. The G Fund is the only fund in the TSP funds that have never dropped. In terms of total returns, the G Fund was the last one to end the 35-year period.

These were just a few examples from the previous 100+ years of the history of U.S. stock and government bond index. Overall speaking, the total value of a portfolio consisting entirely of U.S. stock indexes (such as the C Fund), can recover losses within a year or even three after experiencing a significant decline. The most severe and lengthiest drops may take another year or a maximum of two years to recover. Accounts recover comparatively quicker after short-term drops. This means that an active TSP participant does not need to sell his or her stock funds and continue investing despite the market decline. There are many planned strategies that investors can suggest during downturns. But we must mention here that the buy-and-hold strategy is the best one to stay in the market over long periods of time.

Over a period of time, we will find a solution to recover from the coronavirus, and the U.S. and world markets will recover after ongoing downturns too. By continuous investment in funds during these difficult times, TSP account holders will be able to recover from the losses as well. No doubt, we are going through challenging times, but there is a way to reduce anxiety — at least when it comes to investing — to focus on the long-term goals. We hope and pray for all to stay safe and healthy as the world fights on the coronavirus and struggles to recover globally.