Not affiliated with The United States Office of Personnel Management or any government agency

Federal Employee Retirement and Benefits News

MENUMENU

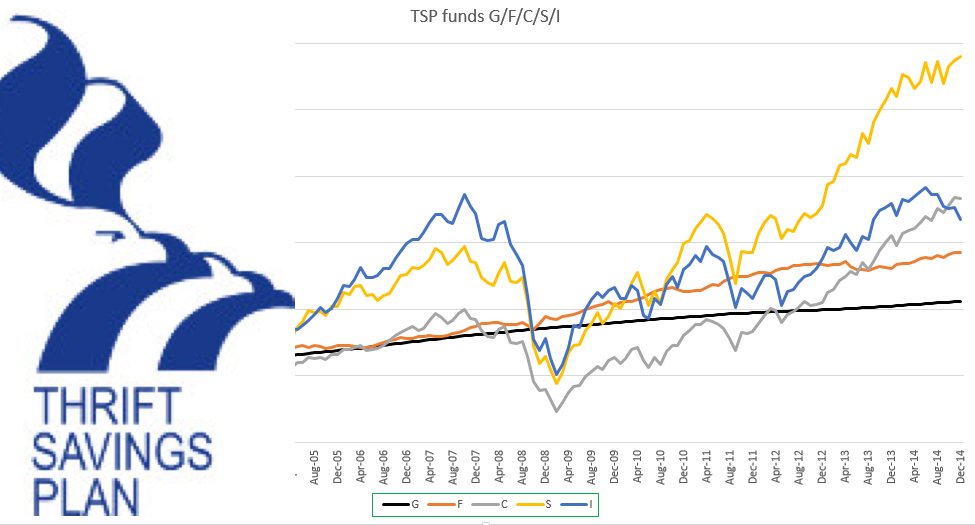

- Thrift Savings Plan

-

Advertisement

-

- FERS

-

- Latest News

- Retirement for Postal Workers: Everything you need to know | Michael Wood

- Defense Department Reports On Take-Rates Projections For BRS

- TSP and Divorce: How The Court Will Handle Your TSP and Other Federal Benefits | Linda Jensen

- Battle Regarding Official Time and TSP Takes Place On Capitol Hill

- Linda Jensen | How You Can Successfully Fund Your Retirement Years

- Latest News

Advertisement

-

- CSRS

- Federal Employee Annuities

- Financial Planning

- Newsletter