What makes IRAs and TSP Different From Each Other? by Bill Eager

What makes IRAs and TSP Different From Each Other? by Bill Eager

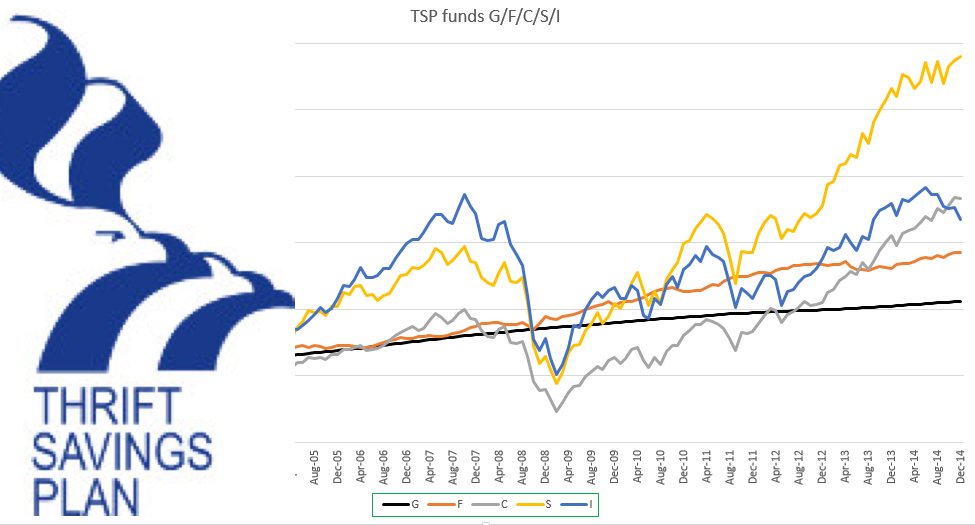

In general, the Thrift Savings Plan (TSP) is more limiting than an Individual Retirement Arrangement (IRA). This fact should not prove to be a surprise for federal employees. As per Bill Eager Legislation that was passed in 1978 approved company retirement plans like 401(k)s, TSP, and others. The premier 401(k), named after the section of the IRC (Internal Revenue Code) that permitted it, was created in 1980, and in 1981, a change to the IRC permitted these plans to be funded via payroll deduction. The TSP made its way in 1987.

Individual Retirement Plans, on the other hand, preceded 401(k)s and were created in 1974. As per Bill Eager a range of similarities was shared by 401(k) with the IRA: both were funded with pre-tax dollars; incorporated penalties for premature withdrawals (before age 59.5 for IRAs and before the year one turns 55 years old for 401(k)s; were completely taxable as ordinary income when withdrawn and incorporated penalties for not being able to take required distributions at and after the age of 70.5. The next legislation resulted in Roth IRAs and plans and also placed income restrictions on some actions of the IRA. But there is still a range of differences between the TSP and an IRA.

The TSP needs to be funded by payroll deduction, while an IRA can easily be funded from any source as long as one possesses sufficient earned income that covers the contribution. One can contribute from their earned income to an IRA for a non-working spouse. Bill Eager said one can take money out of an IRA at any time they want. Even after the implementation of the TSP Modernization Act, the withdrawals of TSP are more delimited than those taken from IRAs.

An IRA gives you the freedom to select where your distribution comes from, and this also includes any specific investment within the Individual Retirement Plan. In TSP, withdrawals need to be made proportionally between funds. Also, unless otherwise specified, distributions are made proportionally between Roth and traditional balances within your Thrift Savings Plan. You cannot possess Roth and traditional money within the same IRA. Both Roth and traditional IRAs are distinct accounts.

The proportionality requirement of TSP’s also prevents individuals from utilizing a ‘bucket strategy’ while making any withdrawals. This bucket strategy is, at times, referred to as a ‘time-based segmentation approach’ and allows you to allocate your money in two or more distinct funds/accounts or ‘buckets.’

Bill Eager said the initial bucket will be invested in safe (probably lower-yielding) investments from which you can make monthly withdrawals for income during your retirement. The second bucket gets invested in riskier (likely higher-yielding) investments, which will not be required for a certain amount of time. You can sporadically replenish bucket one from bucket two. As per Investopedia, a total of 38 percent of financial advisers suggest that their clients should go for the bucket strategy. Though you can choose to participate in both an IRA and TSP, you need to know that they both aren’t the same. They are similar, but not identical.