BLOG

Our blog covers all the latest writings of our most seasoned writers. These normally include the commentaries and opinions made by qualified bloggers working for us and are worth reading to say the least. The topics are very wide ranging and the versatility of our writer-board can be found evident via this.

Visit our blog to read more.

Public Sector Retirement, LLC (‘PSR,’ ‘PSRetirement.com’ or the ‘Site’) is a news channel focusing on federal and postal retirement information. Although PSR publishes information believed to be accurate and from authors that have proclaimed themselves as experts in their given field of endeavor but PSR cannot guarantee the accuracy of any such information not can PSR independently verify such professional claims for accuracy. Expressly, PSR disclaims any liability for any inaccuracies written by authors on the Site, makes no claims to the validity of such information. By reading any information provided by June Kirby or other Authors you acknowledge that you have read and agree to be bound by the Terms of Use

Late Retirement Planning: Pitfalls and Ideas

/by AdminNot all of us are the perfect retiree, with maxed-out IRAs and TSPs and a perfect financial plan. Sometimes, the realities of life have gotten in the way and make it hard to save appropriately for retirement. However, when it gets closer, there are still steps you can take to make sure that you retire safely and comfortably, with a good chunk of hard work.

Stash all the money you can

Since you haven’t had the time for interest to build up, now is the time to start fixing that. If you have access to a TSP account, this would be the best way to save, although you should talk to a TSP specialist to find the right funds for you. If you do not have access to a TSP or 401(k), then a traditional or Roth IRA would be the best place to start, making the maximum allowable contribution.

Don’t expect to rely on Social Security

Social Security and Medicare are currently in danger. While it is not very likely that the program will crash and burn entirely, the fact that the tax laws related to Social Security changed from being tax-free to getting taxed up to 85% in the highest tier means that going forward, relying too much on Social Security could end up being a disadvantage, even if you consider yourself to be in the middle class. However, staying with your job can add to your social security benefits by as much as 7% per year, so the option is still theoretically viable so long as you make intelligent investments.

Work Part-Time as a Supplement

One way to help you as you ease into retirement is downgrading to a part-time job instead of fully quitting the workforce. Not only does this potentially ease the transition into the 25 to 30 years you could potentially be living in retirement, but you could also make some extra money to supplement your savings.

Don’t forget to account for inflation

We are currently in a period of minor inflation, but to become complacent in this period is a dangerous idea. Since you could be spending twenty-five-plus years in retirement, even a minor inflation rate of 3% cuts your purchasing power in half over twenty years. Don’t just make sure that your post-retirement income will match your current cost of living- make sure that you account for the potential weakening of your money over a period of time.

If you feel like you cannot do all of this planning on your own, consulting a financial expert with specialization in the Federal space may be a good idea.

Retirement Planning – Thinking Forward

/by Dianna TafazoliThinking Forward with Retirement Planning

Federal and Postal employees have extensive benefits that they have to navigate during their work career and heading into retirement and therefore their retirement plan. There are a number of benefits that are applicable to employees and their families. Many of those benefits may seem complex to the employee and the family members. It is recommended that employees visit their benefits often and discuss them with their family members in order to gain a better understanding.

It happens too often that employees who have very sound benefits fail to discuss those benefits with family members and what action to take in the event that the employee passes away or becomes impaired to the point of not being able to negotiate for him or herself. Postal employees, for instance, are learning to navigate the LiteBlue page and enjoying all the benefits of LiteBlue and what it has to offer, when it is possible and when necessary, family members should be able to take the tour with the employee.

The benefits offered to an employee during their work career also benefit family members. By the same token, during retirement, family members also need to be aware of the benefits and how they work in retirement in order to be able to take care of important business when the time calls for it.

P. S. Always Remember to Share What You Know.

LiteBlue – PostalEase Serving Postal Workers

/by Dianna TafazoliLiteBlue and PostalEase

PostalEase and LiteBlue help the Postal Service provide service and structure to all the post offices throughout the nation. As I speak to a number of individuals they describe the Postal Service as just their local post office. It is much more than that. It is a the third largest civilian employer in the world with services to the military in conjunction with the Department of Defense commonly called the Army Post Office.

PostalEase and LiteBlue help the Postal Service provide service and structure to all the post offices throughout the nation. As I speak to a number of individuals they describe the Postal Service as just their local post office. It is much more than that. It is a the third largest civilian employer in the world with services to the military in conjunction with the Department of Defense commonly called the Army Post Office.

The Post Office provides the kind of convenience to Americans we have come to depend on. The quality of service that is offered to external customers is often indicative of the service provided to its internal customers – the workforce. Just as postal services are made easy for Americans to take care of their postal needs, LiteBlue via PostalEase makes it easy, fast and convenient for Postal employees to take care of their needs.

PostalEase is a telephone enrollment system implemented by the Postal Service to make Direct Deposit, FEHB decisions, Thrift Savings Plan elections and much more. The Postal employee only needs to call a toll-free number with their Employee ID Number (EIN) and their USPS Personal identification Number (PIN) to gain access to the system or login to www.liteblue.usps.gov.

Postal employees can make Open Season decisions, elect contribution amounts to their TSP.gov account and change their Thrift Savings Plan contribution amounts. Postal employees can also cancel or stop their Thrift Savings Plan contributions. If you use the PostalEase phone service to transact business with allotments/net to bank you must have in addition to your PIN and EIN, your Account Number, the type of account and the 9 digit Routing Number to you banking institution.

If you don’t have a PIN you can also make the request via phone. The PIN will be mailed to your mailing address of record within 10 days. After completing any transactions via LiteBlue-PostalEase, you will receive a confirmation number that should be maintained for your records.

P.S. Always Remember to Share What You Know.

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

LiteBlue – How To Receive A Copy of My Postal Pay Stub

/by AdminIf you are a Postal employee you can easily find a copy of your Postal Service Pay Stub through LiteBlue (www.liteblue.usps.gov)

For the past 40 pay periods (about 20 months) your pay stubs are stored in ePayroll through LiteBlue.

Instructions for ePayroll;

- Visit the LiteBlue

- Enter your USPS employee ID and PIN

- Click the “Log On” button.

- Go to the “Employee Application” carousel

- Choose “ePayroll” from the list of applications.

- Select the “Pay Date” you are in search of

- Your Pay stub show become visible in a separate window.

- In the upper left corner of the window, click the “Print This Page”

Hints and Tips;

1) The PIN you use for PostalEASE is the same PIN you will use to access your Pay stub.

2) You can also access ePayroll through an Internal company computer.

USPS LiteBlue: New LiteBlue PIN

/by AdminUSPS LiteBlue

As of April 28, 2014, Postal employees will be required to use a new password to access USPS LiteBlue / PostalEase and other self-service web applications like eCareer and ePayroll. This move will take place through the usage of a Self-Service Profile (SSP) application (www.ssp.usps.gov) which will be used by employees to create and manage their self-service password, email address, security challenge questions, and 4-digit Personal PIN.

As of April 28, 2014, Postal employees will be required to use a new password to access USPS LiteBlue / PostalEase and other self-service web applications like eCareer and ePayroll. This move will take place through the usage of a Self-Service Profile (SSP) application (www.ssp.usps.gov) which will be used by employees to create and manage their self-service password, email address, security challenge questions, and 4-digit Personal PIN.

“The change to a self-service password (on the LiteBlue system) is necessary to protect and secure employee information,” said Corporate Information Security Officer Chuck McGann. The hope is that by moving to a stronger password, USPS employee data will be more secure and that the LiteBlue online USPS system will able to help protect employee’s personal information better.

If you are a Postal employee you can easily find a copy of your Postal Service Pay Stub through LiteBlue (www.liteblue.usps.gov)

Take the STAPLES® Survey – let your voice be heard.

Employees can access the SSP Password application;

A) Through the Internet at www.liteblue.usps.gov & www.ssp.usps.gov

B) Through the USPS Intranet, via the USPS LiteBlue Page on the Human Resources website, and

C) Through an Employee Self-Service USPS LiteBlue kiosk (available at some facilities).

LiteBlue: How To Use USPS LiteBlue

/by Admin

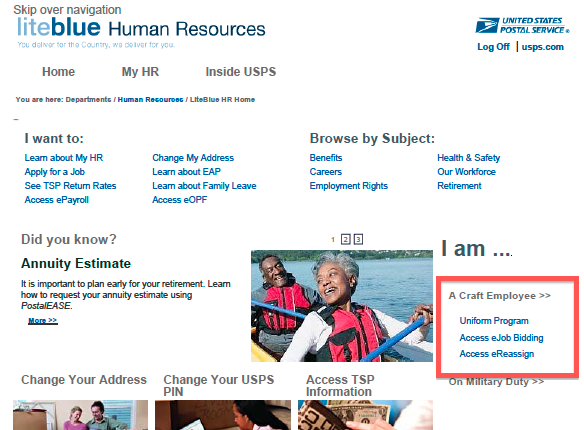

On LiteBlue.usps.gov, enter “I Am A Craft Employee”

How to use LiteBlue

To use LiteBlue and view your information, visit the website (LiteBlue.usps.gov). You will find the site by clicking HERE. The site is maintained by the USPS as part of the United States Postal Service employee service extranet.

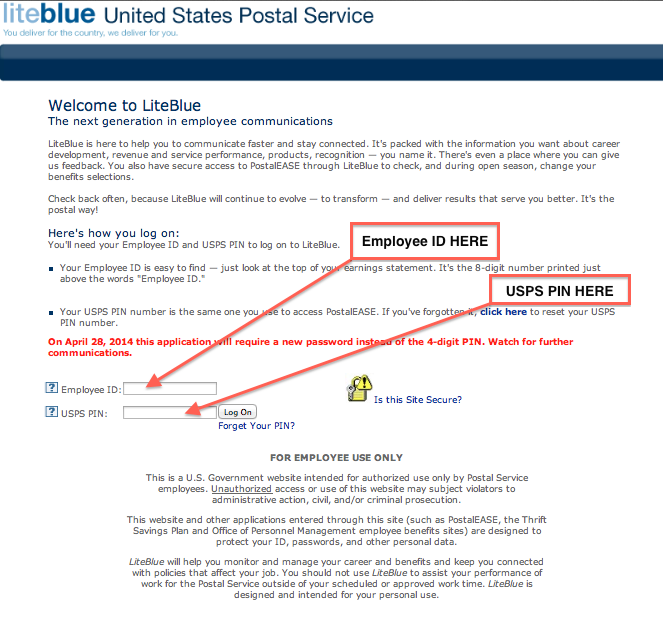

You will need to fill in the required fields on the login screen (see below for visual instructions). You will also need several forms of identification in order to access USPS.

What You Will Need to access your account;

Your USPS employee ID number.

You can find your USPS Employee ID Number on any one of your earnings statements if you do not already know it.

Your USPS PIN number, which was given to you for access to PostalEASE.

Stay up to date on your USPS career development;

By navigating the menus on USPS site you will be able to stay up to date on your career and access other important information.

You can find information about your;

USPS Service performance,

Your Postal Employee benefits package and

USPS revenue.

Leave feedback on USPS.

If you have suggestions or need additional information, select the feedback option.

[my_chatbot]

Contact us for more information

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do before retirement

What Postal Employees Should Do Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications

You can use PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms

The information on this page and website, including links, images, and references are made available to you for information purposes only. Public Sector Retirement, LLC (PSRetirement.com) is NOT affiliated with the USPS or any other Government Agency. PSRetirement.com makes these links available but does not guarantee the information or administer these unrelated sites. PSRetirement.com also cannot access your private employee or retirement information and we cannot reset your PIN numbers or provide you with Tax information. Please review the Terms of Use for clarification and please contact Shared Services or your Post Master for further information.

Basic Employee Death Benefit: Applying for BEDB

/by Dianna TafazoliApplying for Basic Employee De ath Benefit

ath Benefit

If you are a federal or postal employee part of your discussion for putting in place end of life provisions should include what your survivors need to know about applying for the basic employee death benefit.

Whether you are FERS or CSRS all applicants must complete the Standard Form (SF) 3104 – Application for Basic Employee Death Benefit. There is no need to worry about what to do because the instructions are fully outlined on the form. You may under certain circumstances have to complete additional forms.

If the deceased was retired at the time of death and you are the surviving spouse, you would be required to complete SF 3104A – Survivor Supplement which is an attachment to the SF 3104. Here again, the instructions are found on the form.

If the deceased was still an active employee upon his/her death and you are a surviving spouse or the former spouse, you and the deceased’s agency of employment are required to complete SF 3104B – Documentation and Elections in Support of Application for Death Benefits when Deceased was an Employee at the Time of Death. The 3104B can be acquired via the deceased federal employee’s former agency of employment. Instructions for executing the 3104B are found on the form.

Once applicable application materials have been completed it should be submitted to the employee’s employing agency of record if the deceased was still an active employee at the time of death. If the deceased was a former employee or a retiree, the completed application should be sent to the Office of Personnel Management’s Federal Employees Retirement System at P. O. Box 45, Boyers, PA 16017-0045.

Some of the small things we need to know can become an obstacle at a time when our emotions can least afford to be challenged. Start putting the business of the end of your life in place now so that your heartache and sorrow will only be because you are saying goodbye to a loved one.

P.S. Always Remember to Share What You Know.

The federal or postal employee may also have been covered by FEGLI.

Surviving spouse of postal employees may need to visit LiteBlue for information and forms

BEDB – Other Details You Might Need To Know

/by Dianna TafazoliAdditional BEDB Information

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

When you are fully acclimated into the system and begun receiving annuity payments, you can conduct much of your business online, including making any changes you deem necessary. You will receive a password to utilize the services of the online system once your payments begin.

Whether you choose to receive your BEDB payments via direct deposit or the direct express debit card, you will receive all other information relevant to you at the mailing address on file with the Office of Personnel Management.

If your mailing address changes before the processing of your application is completed by OPM and you have not received your claim number you should write to the Office of Personnel Management giving your name, date of birth, social security number and the same for the deceased federal employee. If you have received your claim number you can communicate with OPM via telephone of write to register a change of address.

When addressing any BEDB questions and/or concerns to OPM be sure to always use your claim number on all correspondence.

P. S. Always Remember to Share What You Know.

More information might be available to you on FEGLI and survivor annuity payments

Surviving spouses and family members of postal employees should visit LiteBlue for additional information

Receiving Your BEDB and Survivor Annuity Payment

/by Dianna TafazoliReceiving your BEDB Payment

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Believe it or not, there are still some individuals who do not have bank accounts; they simply choose to handle their business otherwise where they find the most comfort and security. The government recognizes this concern and for individuals who do not have bank accounts, payments can be made through a Direct Express Debit Card. The BEDB annuity payment is automatically deposited to the card on the date you would otherwise receive your annuity payment and is immediately available for your use.

There are some benefits you cannot receive by direct deposit or the express debit card and they are the Basic Employee Death Benefit and the survivor annuity payment if your permanent address where you would ordinarily receive payments is outside of the United States in countries where the automated programs are not available.

You must notify the Office of Personnel Management as to how you wish to receive your BEDB payments by completing Section 1 of SF 3104 – Application for Death Benefits. You can also send the Direct Deposit sign-up form (SF 1199A) to OPM’s Retirement Operations Branch – Boyers, Pennsylvania – P. O. Box 440 – 16017-0440. You and your bank must complete the form. You can also fax the information to OPM. Visit the OPM website for a current fax number.

Open communication is the path to a future you are prepared to meet.

P.S. Always Remember to Share What You Know.

The deceased may have had additional life insurance through FEGLI.

Postal employee families are encourages to visit LiteBlue for information

Estate Planning Definitions

/by Dianna TafazoliEstate Planning Definitions:

These are some common definitions which may arise when you are finalizing your estate planning.

These are some common definitions which may arise when you are finalizing your estate planning.

• Will (Last Will and Testament) – A legal document that defines who will manage your estate; an instruction to a court of law.

• Letter of Instruction – It is an informal document that speaks to the financial and personal matters that must be attended to after one’s death.

• Advance Directive – Documents that include health care guidelines, living wills, medical and health care powers of attorney and other personal directives.

• Power of Attorney – A document that delegates the power to legally take care of financial affairs if one becomes disabled or incapacitated.

• Intestate – Dying without having a will.

• Probate – The process of having an attorney present your Will before a court.

• Estate Planning – A way by which legally effective arrangements are set up to meet specific wishes if something happens to you or your loved ones.

• Durable Power of Attorney (Health Care) – The appointment of a designee to make decisions regarding one’s health care treatment if you are unable to provide informed consent.

• Living Will – An advance directive giving physicians and hospitals your instruction regarding the cessation or provision of health care treatment should you suffer permanent incapacity or an irreversible coma.

• Estate – Consists of all the property a person owns or controls.

• Living Trust – Instrument that allows for holding legal title to and providing a mechanism to manage your property and carry out the instructions you want in the Trust. Instrument continues in force during one’s lifetime even in the event of incapacity and after death.

• Testamentary – Instrument created after death.

• Grantor or Trustor – One who establishes the Trust.

• Trustee – Individual named by the Trust as the controller of the Trust’s assets.

• Beneficiaries – Heirs

Educating ourselves on the varied aspects of retirement challenges and opportunities including planning for the business of the end of our lives is what we need to retire well and enjoy living in our next new adventure.

P. S. Always Remember to Share What You Know.

More information on Retirement Planning can be found HERE

Information on Financial Planning can be viewed HERE

Living Will and Durable Power of Attorney

/by Dianna TafazoliLiving Will and the Power of Attorney

A Living Will is an advanced directive giving doctors and hospitals expressed instructions regarding how you want your health care treatment handled. In the event of incapacitation or an irreversible coma and you are unable to articulate your desires, a Durable Power of Attorney can act on your behalf, while you are still alive, ensuring your wishes are carried out. These types of documents are an incredibly important part of your financial plan. The Living Will is generally focused on whether or not an individual wishes to have his or her life sustained by life support systems. Hospitals and physicians are more and more supportive of patients having a ‘living will.’

A Living Will is an advanced directive giving doctors and hospitals expressed instructions regarding how you want your health care treatment handled. In the event of incapacitation or an irreversible coma and you are unable to articulate your desires, a Durable Power of Attorney can act on your behalf, while you are still alive, ensuring your wishes are carried out. These types of documents are an incredibly important part of your financial plan. The Living Will is generally focused on whether or not an individual wishes to have his or her life sustained by life support systems. Hospitals and physicians are more and more supportive of patients having a ‘living will.’

Whether to sustain life or not by artificial means is such a personal and highly emotional encounter that doctors and hospitals are not eager to bare that responsibility or to have to make such a crucial decision. It is very important that we put plans in place when our capacity to do so is fully intact not leaving painstakingly difficult decisions to be sorted out between family members and loved ones.

For clarity, let’s distinguish between the roles of ‘Power of Attorney’ and ‘Durable Power of Attorney’. Power of Attorney is a fairly well-known concept which is generally invoked for carrying out financial matters when the principal cannot be present. However, when the principal dies the power of attorney also terminates.

Durable Power of Attorney may be a more useful tool when dealing with the elderly and the informed. It allows individuals who can no longer conduct their own financial affairs and affairs otherwise, to continue doing so through the Durable Power of Attorney arrangement. There are no hearings or court proceedings to appoint someone Durable Power of Attorney. It is a simple matter of signing a legal document.

Once again, doing your homework is the key ingredient to success. If you are considering moving in this direction in your planning process, be as certain as humanly possible, that you choose someone you can trust who will always have your best interest at heart.

You may also find it necessary to have both a Medical and Financial Durable Power of Attorney. The Medical Durable Power of Attorney would only be able to handle and speak for your medical treatment and care; while the Financial Durable Power of Attorney would only be able to handle your financial concerns and matters.

In planning your estate, one of the best approaches is to talk to your family about what you plan to do. Open communication with family members and those involved in your life’s achievements concerning how you want to divide your assets is part of implementing an action plan that will help you retire in comfort and security.

P. S. Always Remember to Share What You Know.

For information on your retirement plan and your investments – check your TSP.gov Account regularly.

For postal employees – your PostalEase LiteBlue account is your portal to much more than just your earnings statement

Estate Plan: Living Trusts

/by Dianna TafazoliLiving Trusts in an Estate Plan

Until about 20-30 years ago Living Trusts were thought of as planning tool strictly for the wealthy. Today that is no longer true as the Living Trust is becoming more popular with the because of the tax and privacy advantages offered.

Until about 20-30 years ago Living Trusts were thought of as planning tool strictly for the wealthy. Today that is no longer true as the Living Trust is becoming more popular with the because of the tax and privacy advantages offered.

Living Trusts are generally set up by an Estate Plan Attorney while you are alive. Testamentary trusts are created after death. The choices you make in your financial planning and life planning decisions are highly personal and you are in charge of the course you decide to take.

• Living trusts involve the individual (or a couple if you are married) who secures the Trust and is designated the Grantor or Trustor.

• The Trustee is the individual named by the Trust as the manager or the Trust’s assets and property. The Trustee and Grantor may be the same individual or individuals.

• The third party is the Beneficiary(s). The beneficiaries are the heirs that will receive the fruits of the Trust once the Grantors are deceased.

• Living Trusts are not subject to the laws and regulations of probate. Therefore your wishes can be kept completely private and away from public scrutiny.

• A Trust is defined as a separate legal entity where distributions can be made from the Trustee without any involvement from the courts.

• With a Living Trust, the lengthy wait and cost of probate are avoided.

• As long as the assets have been placed in the Trust, distributions can be made to beneficiaries.

• There are few limitations, if any, once a Trust has been established as to what can become a part of the trust. i.e. stocks and bonds, savings accounts, real estate, personal property, life insurance. Once the assets are placed In Trust, they are changed from your name to the name of the Trust.

It is important to invest some of your time in finding out more about Living Trusts and any other tools that might become a part of your planning process. Doing your homework and learning as much about any tools and strategies you might be considering in the planning process are the best practices to see how they fit into your plan to Retire and Live Well.

P.S. Always Remember to Share What You Know.

There are tax implications to your loved ones if you name your Trust as your beneficiary on your TSP.gov account. Check on your beneficiary designations through TSP.gov or Liteblue.

Wills: Other Tips

/by Dianna TafazoliMore Information on Wills

• If you have a surviving spouse, he or she has a right under most circumstances to inherit a part of your property, even if you don’t name them in the Will.

• If you have a surviving spouse, he or she has a right under most circumstances to inherit a part of your property, even if you don’t name them in the Will.

• If you own property jointly with someone else, upon your death, the property will automatically revert to the other joint holder; irrespective of what you might say in your Will.

• Wills are not irrevocable; they may be changed, amended or modified by the testator (you) at any time deemed necessary.

• Children under 18 must have a guardian named for their care until they reach the age of maturity. This is really important because you do not want anyone else deciding where your children will go in the event of your death. If the children are very young, name an alternate guardian in the event the primary guardian becomes ill, disabled or passes away.

• You might want to create a trust if you have minor children that will inherit your estate. The law prohibits minors from inheriting directly from you. Therefore, you must appoint a trustee to handle their affairs until they reach the age of maturity. You may specify the age at which the child can receive his or her inheritance.

• If you choose an executor: Make sure that this person is willing and capable of handling your estate. You may select a friend, a family member or anyone of your choosing. However, depending on the size of your estate, you might want to choose someone who has the financial and legal acumen to properly handle your estate and in accordance with the rules, laws and regulations of the state where you lived. Sometimes in such cases, you might want to pair a family member or friend with an estate attorney or other professionally trained individual to handle such situations.

• As a Federal Employee, your benefits taken into retirement or otherwise are not bound by your Will. The Federal Government structured itself in such cases to distribute your assets by an established Order of Precedence. The government does not think it prudent to have your assets that are often needed by your family to carry out the final business of your life, tied up in probate for lengthy periods of time.

Every estate, whether small, medium or large, wants to avoid long drawn out probate when possible. The person or persons named as your executors or administrators must appear before a court and:

• Catalog all of your property with full identification.

• Have the property appraised for its value and pay any outstanding debts and taxes.

• Verify that your Wills is a legal and valid document.

• Follow your instructions in the distribution of your property and assets to your heirs.

Again, probate can be costly and time consuming. Remember when choosing an Estate Attorney, it is suggested that you choose one that has at least 10 years of experience in estate planning and that he or she is licensed to practice law in your state of legal residence. By the same token if you need the services of a Financial Advisor choose an advisor that is an expert in federal employee retirement benefits.

P. S. Always Remember to Share What You Know.

Probate

/by Dianna TafazoliProbate

Probate is yet another aspect of Wills. When an attorney represents your Will before the court it is called probate. Wills must go through probate and this can sometimes last for 9 months and maybe longer. It can also be fairly expensive costing anywhere from 2 to 5% or more of the total value of your estate.

Probate is yet another aspect of Wills. When an attorney represents your Will before the court it is called probate. Wills must go through probate and this can sometimes last for 9 months and maybe longer. It can also be fairly expensive costing anywhere from 2 to 5% or more of the total value of your estate.

Often there is such conflict in families that settling the estate is so long and drawn out to the point that only the lawyers seem to benefit because all the assets are eaten up in legal fees. Dealing with the death of a loved one is difficult enough without having to be embroiled in battle with family members over the authenticity of the Will and whether heirs have a legal right to what has been articulated in the Last Will and Testament.

Wills can always be changed, but it is far better to outline the details of your Will when we are really of sound mind and body, not when our mental and physical faculties can be called into question. However, if you become incapacitated during your life time, your Will is completely irrelevant to your health and physical state. Wills are only implemented once you pass away. It is important to name a trustee or give someone “Power of Attorney” if you see that your health and competency might become an issue.

If no one has been named to speak for you in the event of incapacity or incompetency, the court will step-in and decide how your medical treatment and distribution of assets are handled. Planning allows us to have a say in how we want things done. Planning also helps us prevent needless fighting amongst family members so that we can celebrate the lives of our loved one when they pass on.

P. S. Always Remember to Share What You Know.

Will: (Last Will and Testament)

/by Dianna TafazoliThe Will

The Will is the nucleus of the estate plan. From the Will, everything else emanates. Your Last Will and Testament spells out all of your wishes. It details how you want your assets and resources distributed and how your loved ones who depend on you will be taken care of.

The Will is the nucleus of the estate plan. From the Will, everything else emanates. Your Last Will and Testament spells out all of your wishes. It details how you want your assets and resources distributed and how your loved ones who depend on you will be taken care of.

Some Basic Elements of Your Will include:

• Identification of yourself and a description of your right to distribute said property and assets.

• A full and complete description of the property and assets you wish to distribute.

• A very clear detailed itemization of who you want your property and assets to go to.

Wills are instructions to a court of law and can be contested. It is suggested that you take your time to make certain everything is in place and in accordance with the laws of your state. When the Will is registered in the court, it is then a matter of public record and the privacy surrounding it is gone. When naming your heirs, it is also a good rule of thumb to identify them and make a brief statement as to why they are included.

Often Wills become very contentious by family members and other in court. Your loved ones in many cases will not only have the emotion of dealing with your death, but could become involved in a court battle over the validity as well. There are some things that may cause your Will to be invalid in a Court of Law:

• The deceased was not mentally competent and able to comprehend what was happening when the Will was executed.

• The execution was handled improperly, making it improper.

• The writing was done under force and undue influence from another party.

If the court finds the Will to be invalid, circumstances will be treated as if you died intestate (without a Will). At that time, depending on the state you live in, it will be decided in accordance with the law as to how your property and assets will be distributed. In a case where there are no living relatives, your assets will become the property of the state.

P. S. Always Remember to Share What You Know.

Estate Plan

/by Dianna TafazoliEstate Plan

Definition: A legally binding process where arrangement have been made to carry out your wishes if something happens to you or your loved ones. The Estate Plan will outline what is to happen to everything you have accumulated including your health care matters, so in the event you are unable to express your own desires, someone you have selected can do that for you.

Definition: A legally binding process where arrangement have been made to carry out your wishes if something happens to you or your loved ones. The Estate Plan will outline what is to happen to everything you have accumulated including your health care matters, so in the event you are unable to express your own desires, someone you have selected can do that for you.

Generally an estate plan should include the following:

• A Will sometimes called the “Last Will and Testament” (defines who will manage your estate).

• Letter of Instructions (an informal document that speaks to how your personal and financial business should be handled after your death).

• Advance Directive (health care directives, medical power of attorney, living wills and other personalized health care desires when you are unable to speak for yourself).

• Power of Attorney (delegated authority to legally handle your financial affairs if you become disabled or incapacitated).

The value of all property owned at the time of your death constitutes your ‘gross estate’. Your estate may include real estate, life insurance, business holdings, investment in stocks, bonds, mutual funds and other investments, personal bank accounts, IRAs, your 401K and other retirement accounts, automobiles, collectibles, artwork, jewelry, antiques and other personal property.

An Estate Plan is part of the planning process of transitioning into retirement. Some individuals start planning for their estate very early in life. It is never too early to plan, but most of us have accumulated more in the later years of our lives than at the beginning.

Whenever we start to put our Estate Planning in place, we do it because we care about protecting and providing for the ones we love after we are gone. The reality is that we cannot put an Estate Plan in place after we are dead, it must be done while we are alive. It is a part of planning for the inevitable. It is a part of taking care of the business of our lives from beginning to end.

NOTE: When you die, your estate can pass on to your surviving spouse without your spouse having to pay federal estate taxes. However, depending on the value of the estate, your surviving spouse’s estate may have to pay federal estate taxes on the assets upon the surviving spouse’s death.

P. S. Always Remember to Share What You Know.

Estate Planning: Preparing For ‘End of Life’ Business

/by Dianna TafazoliEstate Planning

Preparing one’s self for the end of life business is both frightening and intimidating. Yet, estate planning is something we must all do sooner or later. Getting prepared is one way of taking the fear and anxiety out of preparing for ‘End of Life’ business.

Preparing one’s self for the end of life business is both frightening and intimidating. Yet, estate planning is something we must all do sooner or later. Getting prepared is one way of taking the fear and anxiety out of preparing for ‘End of Life’ business.

Estate planning for the end of our lives can be an emotional undertaking and one that if we had a choice, we would avoid altogether. Estate planning for the end of our lives, however, is inevitable. We don’t want to leave our family members puzzled and conflicted about what they think we would want at the end of our lives. It is certainly our desire that we would be lucid and fully capable of conducting our affairs to the very end.

As human beings it is always sad to say goodbye and never pleasant whether it is for a short period of time or at the end of one’s life. Such situations can be made bearable when we leave our loved ones behind if proper planning is put in place. Being aware of how the death of one’s partner can impact income and expenses is critical in making sure that your estate plan is in place.

In this series of posts we will discuss topics important to preparing for the end of life business that must be a key priority for each of us. We will also define terms that will give us a better understanding of what is involved in planning for the end of our lives.

P. S. Always Remember to Share What You Know.

Click HERE for information on Estate Planning

Phased Retirement Plan – Other Provisions

/by Dianna TafazoliPhased Retirement Plan

Currently both CSRS and FERS employees may use unused sick leave to add to their years of service, but not towards eligibility for their Phased Retirement plan.

Currently both CSRS and FERS employees may use unused sick leave to add to their years of service, but not towards eligibility for their Phased Retirement plan.

Unused sick leave cannot be used in computing the Phased Retirement annuity. Upon full retirement, however, unused sick leave will be considered and its value will be the same as individuals retiring from full-time employment in the federal service.

Employees who opt to participate in Phased Retirement plan may return to full-time employment upon agency approval. When returning to full-time employment, the Phased Retirement plan annuity will cease.

When the individual retires, the retirement will be calculated under the current law in effect at the time and the phased period of retirement will be treated as part-time. Individuals returning to full-time employment may not re-enter the Phased Retirement Program.

P. S. Always Remember to Share What You Know.

OTHER PHASED RETIREMENT RELATED ARTICLES

Mandatory Retirement vs. Phased Retirement Classification

/by Dianna TafazoliPhased Retirement vs. Mandatory Retirement

Individuals under special retirement conditions such as mandatory retirement may not participate in the Phased Retirement program.

The classification of employees not eligible for participation are Law Enforcement Officers (LEOs), Air Traffic Controllers, Firefighters, Nuclear Materials Couriers, Customs and Border Protection Officers and members of the Capitol Police or Supreme Court Police.

NOTE: Those Customs and Borders Protection Officers who were ‘grandfathered’ are not bound by mandatory retirement provisions, and therefore may participate in Phased Retirement.

SPECIAL NOTE: Persons who have mandatory retirement ages must retire from their classification. That does not mean those individual are ineligible to work outside of their classification.

P. S. Always Remember to Share What You Know.

OTHER PHASED RETIREMENT RELATED ARTICLES

Explanation of Phased Retirement

Phased Retirement – Survivors Benefit

/by Dianna TafazoliPhased Retirement

The Phased Retirement program as it stands provides no survivor benefit based on the proposed Phased Retirement annuity.

The Phased Retirement program as it stands provides no survivor benefit based on the proposed Phased Retirement annuity.

However, if the employee dies prior to full retirement, survivor benefits will be the same as an employee who dies in service. Some minor adjustments will be made as the special structure of the Phased Retirement program dictates.

Although the Phased Retirement period will be treated as part-time when computing the survivor annuity, the basic Employee Death Benefit will be based on the full-time earnings of the employee’s position. Remember to stay up to date on the current information to ensure your retirement is comfortable and secure. There is no such thing as ‘over-preparation’ when concerning your retirement. Be sure to utilize the links at the bottom of this article to ensure you have a solid understanding of the topic. Individuals under special retirement conditions such as mandatory retirement may not participate in the Phased Retirement program.

P. S. Always Remember to Share What You Know.

OTHER RELATED ARTICLES