liteblue.usps.gov

liteblue.usps.gov is the website via which the federal employees can access liteblue which is a portal to get information from, for the federal employees.

LiteBlue – PostalEase Serving Postal Workers

/by Dianna TafazoliLiteBlue and PostalEase

PostalEase and LiteBlue help the Postal Service provide service and structure to all the post offices throughout the nation. As I speak to a number of individuals they describe the Postal Service as just their local post office. It is much more than that. It is a the third largest civilian employer in the world with services to the military in conjunction with the Department of Defense commonly called the Army Post Office.

PostalEase and LiteBlue help the Postal Service provide service and structure to all the post offices throughout the nation. As I speak to a number of individuals they describe the Postal Service as just their local post office. It is much more than that. It is a the third largest civilian employer in the world with services to the military in conjunction with the Department of Defense commonly called the Army Post Office.

The Post Office provides the kind of convenience to Americans we have come to depend on. The quality of service that is offered to external customers is often indicative of the service provided to its internal customers – the workforce. Just as postal services are made easy for Americans to take care of their postal needs, LiteBlue via PostalEase makes it easy, fast and convenient for Postal employees to take care of their needs.

PostalEase is a telephone enrollment system implemented by the Postal Service to make Direct Deposit, FEHB decisions, Thrift Savings Plan elections and much more. The Postal employee only needs to call a toll-free number with their Employee ID Number (EIN) and their USPS Personal identification Number (PIN) to gain access to the system or login to www.liteblue.usps.gov.

Postal employees can make Open Season decisions, elect contribution amounts to their TSP.gov account and change their Thrift Savings Plan contribution amounts. Postal employees can also cancel or stop their Thrift Savings Plan contributions. If you use the PostalEase phone service to transact business with allotments/net to bank you must have in addition to your PIN and EIN, your Account Number, the type of account and the 9 digit Routing Number to you banking institution.

If you don’t have a PIN you can also make the request via phone. The PIN will be mailed to your mailing address of record within 10 days. After completing any transactions via LiteBlue-PostalEase, you will receive a confirmation number that should be maintained for your records.

P.S. Always Remember to Share What You Know.

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

LiteBlue Program: Log On 3

/by Dianna TafazoliThe LiteBlue Program

More information on the LiteBlue program and continued from;

Log On To LiteBlue

Log On To LiteBlue – Continue 1

LiteBlue ‘My Benefits’ also house additional benefits information and solutions for Postal employees. In addition to an explanation of benefits, LiteBlue offers a Monthly Planning Calendar that contains pay periods and pay dates and holidays. The LiteBlue calendar is designed to help Postal employees track their plans and things to do via a monthly planning calendar. Postal employment opportunities are also advertised via LiteBlue.

The comprehensive communications dynamic offerd through LiteBlue continues with eReassignment, allowing Postal employees to apply for reassignment in other districts where availability exists. Health Care Providers are also listed giving Postal workers access to their health plan providers with the ability to search and compare health care plans and review health plans on a state-by-state basis.

Below are a listing of other benefits and their explanation under the My Benefits section of LiteBlue:

Thrift Savings Plan (TSP) detailing account information, fund investment elections and publications.

• TSP.gov Account Access

• TSP Fund Rates of Return

• TSP Calculators

• TSP Forms and Publications

• TSP Information

Contribution election through PostalEASE

• Sign Up/Change TSP

• TSP Catch-Up Contributions

The benefits offered to Postal Employees through LiteBlue not only provide security in building a life their families can depend on, but extend into retirement with proper planning. All the information is placed in one convenient location so that planning for your retirement future is made easy. Let LiteBlue help you retire well.

P. S. Always Remember to Share What You Know.

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

USPS LiteBlue: Stay Connected With LiteBlue

/by Dianna TafazoliStaying Connected with USPS LiteBlue

The United States Postal Service has one of the most efficient ways to stay connected with its employees through USPS Liteblue. It is fast and packed with the kind of information employees need as they plan their careers with the Postal Service.

The United States Postal Service has one of the most efficient ways to stay connected with its employees through USPS Liteblue. It is fast and packed with the kind of information employees need as they plan their careers with the Postal Service.

USPS LiteBlue houses the most important dynamic that a communications and information system can have. It allows employees of the Postal Service to provide feedback on what they would like to see as part of the benefits and provisions offered to them.

LiteBlue has a plethora of information about career development opportunities, revenue and service performance something many employees may not feel falls on their plates. The Postal Service is somewhat different from many areas of the Federal Government, they sale services that every American benefits from. We buy stamps to mail letters and other pieces of information. Although, automation is around and many have gravitated towards electronic mail, the services of the Post Office are still very relevant.

I enjoy the cards my friends and family send to me through the U.S. Postal Service. It is a special feeling to have someone take the time to purchase a card, address it and get it to the post office to be mailed. It is a part of America’s history. Postal employees are well served to look at the revenue and service performance of the Postal Service. LiteBlue also introduces products and recognition among so many other topics that can be accessed by Postal employees.

LiteBlue is a dynamic communications piece that allows Postal Employees to stay connected 24 hours a day. Postal Employees can access their benefits profile. They can view their accounts and make changes to their benefits during open season through a secure portal PostalEASE via LiteBlue.

Postal employees and all Federal Employees should visit relevant information sites often to make sure they are getting the information so critical to capturing all the career development opportunities available and how to begin planning early for a retirement future that is secure and safe.

P. S. Always Remember to Share What You Know

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

USPS LiteBlue: Access to More Than Just Your Earnings Statement

/by AdminePAYROLL is another www.LiteBlue.usps.gov feature available to you through USPS LiteBlue ‘MY HR.’

“Employee apps” such as “My HR” have been available for several years now through LiteBlue — your HR website on USPS LiteBlue. Among your self-service Employee apps is ePayroll, which is available to nearly all USPS employees (rural delivery employees are not included) who wish to use direct deposit.

The USPS LiteBlue ePayroll app is available to USPS employees 24 hours a day giving you immediate access to your earning statements. Employees can review their earning statements for up to 40 consecutive previous pay periods. (Don’t forget that your USPS LiteBlue access is removed once you separate from service).

Take the STAPLES® Survey – let your voice be heard.

Earnings statements on LiteBlue ePayroll is available the employee once new records are processed. The LiteBlue ePayroll statements provide more detail than traditional printed statements on processed allotments, benefit deductions, withholdings and leave balances. In addition LiteBlue ePayroll also provides the user with online guides so employees can better understand their earnings statements and all of the information contained within them.

“Go Green” with ePayroll

Employees who wish can also store their records electronically on their computers without the need to print out the statements themselves.

How to Access ePayroll (you have 3 ways):

· Go to www.LiteBlue.usps.gov

o Select the Employee Apps ‘carousel’ at the center of the home page.

· On LiteBlue;

o Select the My HR tab and then the “Find Employee Apps” section.

· On LiteBlue;

o Select the employee apps button near the bottom of the ‘My HR’ pages.

What can you do on LiteBlue?

Payroll:

Allotment and Net-to-Bank selections

e-Travel net-to-bank options

Make changes to your Federal W-4

Add, cancel or change your Savings Bond options

View up to 15 years of earnings W-2

Benefits:

Use PostalEase

Change your FEHB options

Enroll, change or cancel your Thrift Savings Plan contributions

You can only change, enroll or cancel your Thrift Savings Plan through LiteBlue. To make Thrift Savings Plan fund transfers, request a Thrift Savings Plan Loan or withdrawal and also view periodic Thrift Savings Plan statements please access your TSP.gov account directly.

Add, change or cancel your Thrift Savings Plan Catch-up contributions

Enroll in a Flexible Spending Account (FSA)

Request an Annual Leave Exchange

NOTE: These selections are typically made during Open Season – You should verify the dates for Open Season.

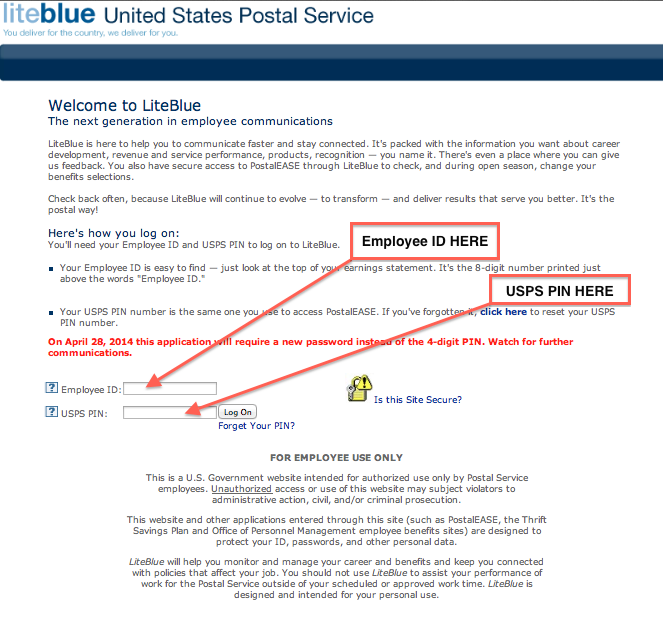

USPS employees will need their Employee ID and USPS PIN number in order to access LiteBlue. For further information on how to use LiteBlue click HERE.

Other LiteBlue Related Pages

What Is LiteBlue?

PostalEase / LiteBlue

What Postal Employees Should Do On LiteBlue Before Retirement

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

LiteBlue: How To Use USPS LiteBlue

/by Admin

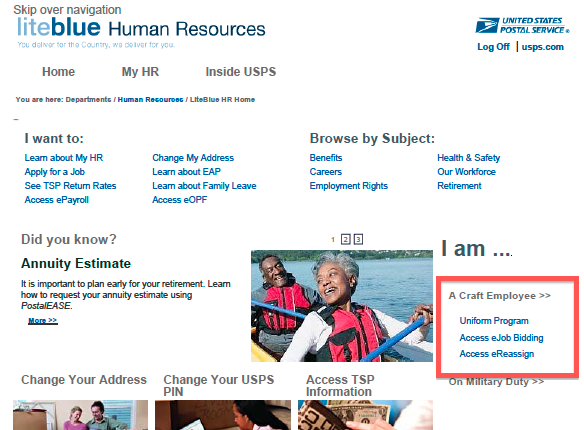

On LiteBlue.usps.gov, enter “I Am A Craft Employee”

How to use LiteBlue

To use LiteBlue and view your information, visit the website (LiteBlue.usps.gov). You will find the site by clicking HERE. The site is maintained by the USPS as part of the United States Postal Service employee service extranet.

You will need to fill in the required fields on the login screen (see below for visual instructions). You will also need several forms of identification in order to access USPS.

What You Will Need to access your account;

Your USPS employee ID number.

You can find your USPS Employee ID Number on any one of your earnings statements if you do not already know it.

Your USPS PIN number, which was given to you for access to PostalEASE.

Stay up to date on your USPS career development;

By navigating the menus on USPS site you will be able to stay up to date on your career and access other important information.

You can find information about your;

USPS Service performance,

Your Postal Employee benefits package and

USPS revenue.

Leave feedback on USPS.

If you have suggestions or need additional information, select the feedback option.

[my_chatbot]

Contact us for more information

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do before retirement

What Postal Employees Should Do Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications

You can use PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms

The information on this page and website, including links, images, and references are made available to you for information purposes only. Public Sector Retirement, LLC (PSRetirement.com) is NOT affiliated with the USPS or any other Government Agency. PSRetirement.com makes these links available but does not guarantee the information or administer these unrelated sites. PSRetirement.com also cannot access your private employee or retirement information and we cannot reset your PIN numbers or provide you with Tax information. Please review the Terms of Use for clarification and please contact Shared Services or your Post Master for further information.

BEDB – Other Details You Might Need To Know

/by Dianna TafazoliAdditional BEDB Information

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

When you are fully acclimated into the system and begun receiving annuity payments, you can conduct much of your business online, including making any changes you deem necessary. You will receive a password to utilize the services of the online system once your payments begin.

Whether you choose to receive your BEDB payments via direct deposit or the direct express debit card, you will receive all other information relevant to you at the mailing address on file with the Office of Personnel Management.

If your mailing address changes before the processing of your application is completed by OPM and you have not received your claim number you should write to the Office of Personnel Management giving your name, date of birth, social security number and the same for the deceased federal employee. If you have received your claim number you can communicate with OPM via telephone of write to register a change of address.

When addressing any BEDB questions and/or concerns to OPM be sure to always use your claim number on all correspondence.

P. S. Always Remember to Share What You Know.

More information might be available to you on FEGLI and survivor annuity payments

Surviving spouses and family members of postal employees should visit LiteBlue for additional information

Receiving Your BEDB and Survivor Annuity Payment

/by Dianna TafazoliReceiving your BEDB Payment

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Believe it or not, there are still some individuals who do not have bank accounts; they simply choose to handle their business otherwise where they find the most comfort and security. The government recognizes this concern and for individuals who do not have bank accounts, payments can be made through a Direct Express Debit Card. The BEDB annuity payment is automatically deposited to the card on the date you would otherwise receive your annuity payment and is immediately available for your use.

There are some benefits you cannot receive by direct deposit or the express debit card and they are the Basic Employee Death Benefit and the survivor annuity payment if your permanent address where you would ordinarily receive payments is outside of the United States in countries where the automated programs are not available.

You must notify the Office of Personnel Management as to how you wish to receive your BEDB payments by completing Section 1 of SF 3104 – Application for Death Benefits. You can also send the Direct Deposit sign-up form (SF 1199A) to OPM’s Retirement Operations Branch – Boyers, Pennsylvania – P. O. Box 440 – 16017-0440. You and your bank must complete the form. You can also fax the information to OPM. Visit the OPM website for a current fax number.

Open communication is the path to a future you are prepared to meet.

P.S. Always Remember to Share What You Know.

The deceased may have had additional life insurance through FEGLI.

Postal employee families are encourages to visit LiteBlue for information

BEDB: Basic Employee Death Benefit

/by Dianna TafazoliBasic Employee Death Benefit (BEDB)

Federal employees’ spouses may be entitled to a Basic Employee Death Benefit (BEDB) upon the death of the employee if the following conditions are met:

Federal employees’ spouses may be entitled to a Basic Employee Death Benefit (BEDB) upon the death of the employee if the following conditions are met:

• You were married to the deceased employee for at least nine months. If the death occurred as a result of an accident, then the 9 month requirement does not apply.

• You were the parent of a child born out of the marriage even if the child was born after the death of the employee or retiree. You are also entitled if the child was born out of wedlock and you and the deceased federal employee later married.

Under these provisions as the spouse you may be eligible for the BEDB that is equal to 50% of the employee’s final salary or the employee’s average salary if it is higher than the final salary plus $15,000.

The $15,000 is increased by the Civil Service Retirement System’s cost-of-living adjustments.

The same benefit may be paid to a former spouse in whole or partially if there is a court order on file at the Office of Personnel Management (OPM) qualifying the ex-spouse to receive the benefit. The former spouse must have been married to the deceased federal employee for at least nine months and did not remarry prior to reaching age 55.

It is important to know the facts so that important aspects of your federal retirement benefits and provisions can become part of your planning process to retire well. If there are details about your benefits that you need more clarity on, visit your human resources office if you are an active federal employee. If you are retired use your CSA number to contact the Office of Personnel Management so that you will know everything needed to live and retire in comfort and security.

P. S. Always Remember to Share What You Know.

You May also wish to look into Federal Employees Group Life Insurance (FEGLI) benefits

For more information on benefits of CSRS employees click HERE

For more information on benefit of FERS employees click HERE

Information for Postal employees will be found at www.LiteBlue.usps.gov

Living Will and Durable Power of Attorney

/by Dianna TafazoliLiving Will and the Power of Attorney

A Living Will is an advanced directive giving doctors and hospitals expressed instructions regarding how you want your health care treatment handled. In the event of incapacitation or an irreversible coma and you are unable to articulate your desires, a Durable Power of Attorney can act on your behalf, while you are still alive, ensuring your wishes are carried out. These types of documents are an incredibly important part of your financial plan. The Living Will is generally focused on whether or not an individual wishes to have his or her life sustained by life support systems. Hospitals and physicians are more and more supportive of patients having a ‘living will.’

A Living Will is an advanced directive giving doctors and hospitals expressed instructions regarding how you want your health care treatment handled. In the event of incapacitation or an irreversible coma and you are unable to articulate your desires, a Durable Power of Attorney can act on your behalf, while you are still alive, ensuring your wishes are carried out. These types of documents are an incredibly important part of your financial plan. The Living Will is generally focused on whether or not an individual wishes to have his or her life sustained by life support systems. Hospitals and physicians are more and more supportive of patients having a ‘living will.’

Whether to sustain life or not by artificial means is such a personal and highly emotional encounter that doctors and hospitals are not eager to bare that responsibility or to have to make such a crucial decision. It is very important that we put plans in place when our capacity to do so is fully intact not leaving painstakingly difficult decisions to be sorted out between family members and loved ones.

For clarity, let’s distinguish between the roles of ‘Power of Attorney’ and ‘Durable Power of Attorney’. Power of Attorney is a fairly well-known concept which is generally invoked for carrying out financial matters when the principal cannot be present. However, when the principal dies the power of attorney also terminates.

Durable Power of Attorney may be a more useful tool when dealing with the elderly and the informed. It allows individuals who can no longer conduct their own financial affairs and affairs otherwise, to continue doing so through the Durable Power of Attorney arrangement. There are no hearings or court proceedings to appoint someone Durable Power of Attorney. It is a simple matter of signing a legal document.

Once again, doing your homework is the key ingredient to success. If you are considering moving in this direction in your planning process, be as certain as humanly possible, that you choose someone you can trust who will always have your best interest at heart.

You may also find it necessary to have both a Medical and Financial Durable Power of Attorney. The Medical Durable Power of Attorney would only be able to handle and speak for your medical treatment and care; while the Financial Durable Power of Attorney would only be able to handle your financial concerns and matters.

In planning your estate, one of the best approaches is to talk to your family about what you plan to do. Open communication with family members and those involved in your life’s achievements concerning how you want to divide your assets is part of implementing an action plan that will help you retire in comfort and security.

P. S. Always Remember to Share What You Know.

For information on your retirement plan and your investments – check your TSP.gov Account regularly.

For postal employees – your PostalEase LiteBlue account is your portal to much more than just your earnings statement

Estate Plan: Living Trusts

/by Dianna TafazoliLiving Trusts in an Estate Plan

Until about 20-30 years ago Living Trusts were thought of as planning tool strictly for the wealthy. Today that is no longer true as the Living Trust is becoming more popular with the because of the tax and privacy advantages offered.

Until about 20-30 years ago Living Trusts were thought of as planning tool strictly for the wealthy. Today that is no longer true as the Living Trust is becoming more popular with the because of the tax and privacy advantages offered.

Living Trusts are generally set up by an Estate Plan Attorney while you are alive. Testamentary trusts are created after death. The choices you make in your financial planning and life planning decisions are highly personal and you are in charge of the course you decide to take.

• Living trusts involve the individual (or a couple if you are married) who secures the Trust and is designated the Grantor or Trustor.

• The Trustee is the individual named by the Trust as the manager or the Trust’s assets and property. The Trustee and Grantor may be the same individual or individuals.

• The third party is the Beneficiary(s). The beneficiaries are the heirs that will receive the fruits of the Trust once the Grantors are deceased.

• Living Trusts are not subject to the laws and regulations of probate. Therefore your wishes can be kept completely private and away from public scrutiny.

• A Trust is defined as a separate legal entity where distributions can be made from the Trustee without any involvement from the courts.

• With a Living Trust, the lengthy wait and cost of probate are avoided.

• As long as the assets have been placed in the Trust, distributions can be made to beneficiaries.

• There are few limitations, if any, once a Trust has been established as to what can become a part of the trust. i.e. stocks and bonds, savings accounts, real estate, personal property, life insurance. Once the assets are placed In Trust, they are changed from your name to the name of the Trust.

It is important to invest some of your time in finding out more about Living Trusts and any other tools that might become a part of your planning process. Doing your homework and learning as much about any tools and strategies you might be considering in the planning process are the best practices to see how they fit into your plan to Retire and Live Well.

P.S. Always Remember to Share What You Know.

There are tax implications to your loved ones if you name your Trust as your beneficiary on your TSP.gov account. Check on your beneficiary designations through TSP.gov or Liteblue.

LiteBlue: What Postal employees should do on LiteBlue Before Retirement

/by Admin

What Postal employees should do on

LiteBlue.usps.gov

Before Retirement and Separation

Your information that is currently available on LiteBlue will be gone after your separation. Once you leave service LiteBlue will no longer be available to you, so be sure to download the following list from LiteBlue so you can maintain your own records.

Your information that is currently available on LiteBlue will be gone after your separation. Once you leave service LiteBlue will no longer be available to you, so be sure to download the following list from LiteBlue so you can maintain your own records.

Before You Retire Access LiteBlue and Retain the Following Records

- Your entire eOPF,

- earnings statements in ePayroll,

- W-2s in PostalEASE and

- anything else you may want in the future

Periodically, postal employees will face challenges with OPM after retirement and will need these documents. All of this can be found through your LiteBlue Account and should be downloaded and saved before your retirement.

To download your entire eOPF;

- Click on “Access Personnel Folder Now!” and

- Choose “Print Entire eOPF.”

- On the LiteBlue account, (Once the .PDF is generated you will be able to find it in a small box at the lower left corner of your LiteBlue screen. You will want to save the .PDF to your computer and possibly save a printed copy for your records.

If eligible for an incentive payment;

Download PS Form 3077

- Give your employing office the address where you want your incentive payment to be sent.

- The incentive agreement stipulates that eligible employees will complete PS Form 3077, Request to Forward Salary Check, and submit it to their employing office.

- In the absence of a PS Form 3077, incentive payments will be mailed to the location where you last worked.

o Download the PS Form 3077 Here

Update your address through LiteBlue. In the event you have difficulty with your LiteBlue account access, as some have, this would be another reason to submit PS Form 3077.

Other LiteBlue Related Pages

What Is LiteBlue?

PostalEase

What Postal Employees Should Do Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Postal and Open Season

Postal Retirement – Preparing the Workforce

/by Dianna TafazoliPreparing for Postal Retirement

The Postal Service has several programs designed to secure upward mobility for its workforce. There is an Advanced Leadership Program, an Associate Supervision Program, a National Center for Employee Development and a Managerial Leadership Program and an online platform to access your benefit information and make certain elections, LiteBlue.usps.gov. All of these programs are designed to help the Postal Employees grow in their career and prepare for retirement.

The Postal Service has several programs designed to secure upward mobility for its workforce. There is an Advanced Leadership Program, an Associate Supervision Program, a National Center for Employee Development and a Managerial Leadership Program and an online platform to access your benefit information and make certain elections, LiteBlue.usps.gov. All of these programs are designed to help the Postal Employees grow in their career and prepare for retirement.

Each program, from LiteBlue to the Thrift Savings Plan, is designed to help and to develop a workforce of excellence, equipped with the knowledge, skills and abilities to implement operations required by high-tech equipment and practices necessary to carry-out the complex work of the Postal Service and to retire comfortably.

In order to reach the Postal Service’s large and multi-jurisdictional workforce, the service uses a plethora of e-learning tools and other technology to train its employees. The Postal Service’s training profile is designed to recruit and train program leaders and managers up to the executive level of operations.

An unfortunate reality, however, is the fact that the USPS has chosen to remove most HR functions from local Post Office with the creation of the Shared Services. The need for direction, therefore, on HR and Retirement related questions often falls to potentially untrained individuals at your Station and word of mouth recommendations. The need for financial professionals has never been more important to the Postal employees and soon to be retirees because of the demographic shift and the aging of the workforce, along with the ever increasing complexity in TSP funds and recommendations, FEGLI comparisons and ways for these employees to protect their lifestyle and financial well-being in retirement.

If you’re a Postal employee and have questions on your benefits and postal retirement, PSRetirement.com can provide you with introductions to local FERS, CSRS, TSP and FEGLI experts and may be able to facilitate a free Benefit Analysis for you and members of your office or Local Union looking for direction or help. Regardless of where you turn, make sure that you are getting the information you rely upon from a competent expert in your complex benefit and retirement options.

Information on the unique benefits for Postal Employees is also important to understand

Other Postal Retirement and LiteBlue Related Pages

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

Annual Leave (Gap Money)

/by Dianna TafazoliAnnual Leave (Gap Money)

We have talked about saving and taking on more personal responsibility for our retirement years and a federal or postal employees unused Annual Leave can represent an important vehicle to accomplish this goal. We also spoke about saving by fully funding the Thrift Savings Plan (TSP) as one way to build up your financial resources for your retirement years. But in addition to any savings you have built up in your TSP, by the time the average federal worker retires, their annual leave accrual represents 8 hours per pay period or 16 hours per month, roughly 2 days per month. Postal workers earn slightly less in Annual Leave accrual (check LiteBlue for more information). Accumulating and saving your annual leave can make your transition from work to retirement much easier.

We have talked about saving and taking on more personal responsibility for our retirement years and a federal or postal employees unused Annual Leave can represent an important vehicle to accomplish this goal. We also spoke about saving by fully funding the Thrift Savings Plan (TSP) as one way to build up your financial resources for your retirement years. But in addition to any savings you have built up in your TSP, by the time the average federal worker retires, their annual leave accrual represents 8 hours per pay period or 16 hours per month, roughly 2 days per month. Postal workers earn slightly less in Annual Leave accrual (check LiteBlue for more information). Accumulating and saving your annual leave can make your transition from work to retirement much easier.

The Office of Personnel Management (OPM) continues to deal with the challenge of eliminating ‘interim annuity’ payments to retirees. Interim payments represent approximately 75% or slightly more of the full retirement annuity. As you put your PLAN for retirement in place, recognize that your full annuity check may not be immediately available and you may need to wait to access your TSP money too and this is where your unused annual leave may come in handy. Evaluate what your expenses will be and how much income you will need to cover those expenses. If you find that a gap exists, your annual leave check might be the GAP MONEY you need to close the divide.

Your annual leave check arrives about the same time as your final paycheck; perhaps weeks before you receive your interim annuity check. Carefully looking into all resources available to you, such as your TSP or unused Annual Leave, and managing those resources well will allow for a smooth transition to retiring well.

P. S. Always Remember to Share What You Know.

More On FEGLI

/by Dianna Tafazoli Each time I think I have said enough about FEGLI, someone or something always reminds me that I have not, or at least I could be a bit clearer on certain aspects of FEGLI.

Each time I think I have said enough about FEGLI, someone or something always reminds me that I have not, or at least I could be a bit clearer on certain aspects of FEGLI.

Over the weekend, a friend called for some advice on her pending retirement. We started to talk about FEGLI (watch the video) and her understanding of elections and goals for life insurance. Right off, she wasn’t sure about what she had and how it worked and if she elected reductions or named a beneficiary(s).

The point being she is about 4 months from deciding on an exact date to retire and one of the most important aspects of her planning process remains vague. There is no denying, there is no easy way of getting around understanding your benefits and what they mean in retirement. She is doing the right thing; she is talking NOW about what she does not understand about her benefits.

Many employees are missing out on a great opportunity to engage their human resources offices and gather as much information as possible about their benefits in retirement. Your agency human resources office has your folder and they can answer so many critical questions and help you via the wonderful online calculators and e-tools to estimate what your annuity from your years of service will look like in retirement.

Another important issue she unearthed was not having a full understanding of her TSP being separate from the pension (annuity) she would receive upon retirement. She also did not have a clear understanding of whether she had named a beneficiary on her TSP account.

Some of her issues were easy to resolve. First, if you are planning to retire, you should not bother yourself about whether you named a beneficiary or even who it was. So many changes take place in our lives over the course of our work careers that the easiest approach to the beneficiary question – is to do a completely new set of forms as part of your retirement check-up list.

Many of us enter into the federal service very young and we make our choices and designations, often not revisiting those forms for a very long time, if ever. This was certainly the case with my friend, even some of the designees she named had passed away.

Getting ready for retirement is a huge undertaking so wherever you can simplify the process, do it. Take the fuss out of what you did not do and what you thought you did and just complete a whole new set of forms for FEGLI. Also contact the Thrift Savings Plan (TSP) and complete a new set of forms with the TSP as well.

We are going to discuss and clarify a couple of things about FEGLI to follow.

P.S. Always Remember to Share What You Know.

RELATED TOPICS – More Federal and Postal Insurance Information

Federal Employees Health Benefits (FEHB)

Federal Flexible Spending Account (FSAFEDS)

Federal Long Term Care Insurance Program (FLTCIP)

Federal Employees and Medicare

Federal Employee Dental and Vision Insurance Program (FEDVIP)

Suspending My FEHB

/by Dianna TafazoliWhat Happens If I drop of suspend my FEHB – Can I Ever Get it Back?

That’s a good question and one that is extremely valuable in planning for a comfortable and secure retirement. When you get the information needed to make informed decisions you can ensure that you will retire well.

That’s a good question and one that is extremely valuable in planning for a comfortable and secure retirement. When you get the information needed to make informed decisions you can ensure that you will retire well.

If you drop or suspend your FEHB under certain circumstances you can re-enroll? It is always a good idea to talk to your human resources office before you consider taking action to drop or suspend your FEHB.

It should be noted that you cannot enroll in FEHB after you retire if you were not enrolled in the plan at retirement and met the FEHB qualifying criteria. A situation when suspending or dropping your FEHB may be appropriate, is when an employee marries or is married to another federal employee with FEHB coverage. Both spouses having FEHB does not constitute double coverage, as you cannot be covered under two FEHB plans simultaneously. However, each person can decide to carry self only or a family plan can be considered. Whatever the choice, it is always a good idea to weigh the financial burden of the choice made and talking with your chosen financial planner may help with your analysis.

Regardless of your CSRS or FERS eligibility, if you are considering dropping or suspending your FEHB coverage you need to give a very good amount of time and energy to understanding what the impacts may be to you and your family. Although the cost of the FEHB premium changes annually, unlike FEGLI which gets terribly expensive as a person ages, FEHB remains cost competitive in the market with the average employee paying only about 25% of the cost. Having information and discussing options with a professional who is an expert in your benefits and your human resources office will help you make the best decision to retire well.

P. S. Always Remember to Share What You Know.

FEHB and Medicare

/by Dianna TafazoliWhat do FEHB and Medicare have to do with the other?

Americans are living longer and that means going forward we will have an unprecedented number of seniors making up the American population. Unfortunately, as the population ages, we will have a greater need for medical treatment and services – more visits to the doctor and more hospitalizations associated with aging.

Americans are living longer and that means going forward we will have an unprecedented number of seniors making up the American population. Unfortunately, as the population ages, we will have a greater need for medical treatment and services – more visits to the doctor and more hospitalizations associated with aging.

The significant aging population also speaks to a decrease in income and earning capacity among that group due to retirement. As income declines, a balance will only be achieved by realizing a decline in expenses.

One of the greatest increases we face as an aging population is medical costs. One way of keeping your money in your pocket is by making sure your health care needs are covered. It is undeniable that health care will become one of the largest outlays of financial resources as we age.

FEHB will not pay for all our health care needs and neither will Medicare, but having them both should place us in a safe spot. For instance, one of the luxuries of retiring is traveling to other countries for many retirees. If you become ill and need emergency treatment while on travel, your FEHB will cover you, but not Medicare. It is very important to find out exactly what services are covered under your plan, be it FEHB, Medicare or a Medicare Advantage Plan.

Being a federal employee puts you in a very good position as you evaluate your future health care needs. Having the benefit of your FEHB and Medicare just might be one of the safest ways to protect your physical and financial health so that you can retire well.

P. S. Always Remember to Share What You Know.

FEHB – The Decision is Yours

/by Dianna TafazoliWhat You Decide to do With Your FEHB at Retirement is Your Decision…..

The best gift one human being can give to another is the gift of knowledge and information. As you get closer and closer to retirement, you may come across a myriad of discussions about whether you should keep your FEHB when you become eligible for Medicare or whether you should suspend your FEHB or wave goodbye to it. Give your friends, your colleagues, and even give yourself, the knowledge you need to make the best FEHB and Medicare decisions.

The best gift one human being can give to another is the gift of knowledge and information. As you get closer and closer to retirement, you may come across a myriad of discussions about whether you should keep your FEHB when you become eligible for Medicare or whether you should suspend your FEHB or wave goodbye to it. Give your friends, your colleagues, and even give yourself, the knowledge you need to make the best FEHB and Medicare decisions.

I am sure every report you read will have some pretty good sounding reasons as to what you should do with FEHB at retirement. Their arguments might be so convincing that you find it hard to resist their opinion about the very important business of your life and your Medicare or FEHB coverage.

Don’t shy away from reading and listening because you can always pick up some good tips, but remember to educate yourself on the facts – a very key ingredient to ensuring that you retire well. Get a good handle on what your health care goals are for retirement and beyond and whether FEHB fits within those plans. Speak to a professional who is an expert in your benefits and determine how you want to reach those goals and what is the best fit for what you and your family need. As you analyze the business of your life – it becomes urgently important to distinguish between what is required for you to survive and what is simply a matter of what is pleasing.

There is a vast difference between need and want the decision will boil down to what you can afford. That difference will become more and more vivid as you paint a picture, as only you can, of what you want that picture to represent for you and retiring well and your health should be something that you don’t skimp on. Gather, analyze, evaluate all the information on FEHB that you can, along with all of the resources available to you so that you can make an informed decision that has the flexibility to land you in the place that fits your retirement needs to retire well..

P. S. Always Remember to Share What You Know.

FEHB who is a dependent

/by Dianna TafazoliWho is considered a family member eligible as a dependent for coverage under my FEHB benefits?

That is a million dollar question that requires a million dollar answer. The definition of family member is rather broad for federal employees eligible to participate in the Federal Employees Health Benefits program. Below are a list of who is considered a family member for eligibility coverage provisions as a dependent under individual and family enrollment:

That is a million dollar question that requires a million dollar answer. The definition of family member is rather broad for federal employees eligible to participate in the Federal Employees Health Benefits program. Below are a list of who is considered a family member for eligibility coverage provisions as a dependent under individual and family enrollment:

• Children Under Age 26

• Legally Adopted Childreny

• Spouse

• Spouse (Valid Common Law Marriage)

• Recognized natural children( Those born out of wedlock)

• Stepchildren

• Foster Children (Living in a Parent-Child Relationship)

• Children Age 26 and over ((Mental or physical disability before age 26)

and incapable of self-support.

The above list provides the information needed for you to determine who qualifies as a family member dependent and what benefits are available to them as a result of your federal employment. If you are unclear about the determination of a relationship between you and a dependent, your human resources office can work with you to establish who meets the relationship criteria to qualify for coverage as a family member.

P. S. Always Remember to Share What You Know.

Medicare eligibility and participation is important when you are considering your FEHB

Postal FEHB – www.LiteBlue.usps.gov

Transporting FEHB

/by Dianna TafazoliTransporting FEHB

What Could Prevent You From Carrying your FEHB coverage into Retirement?

There might be some other conditions that prevent you from carrying your FEHB into retirement. If something happens that prevents you from carrying your FEHB into retirement, your coverage will still be active for 31 days at no cost to you. When that time expires, you either must drop the FEHB coverage, continue for a period of time or convert to an individual policy.

There might be some other conditions that prevent you from carrying your FEHB into retirement. If something happens that prevents you from carrying your FEHB into retirement, your coverage will still be active for 31 days at no cost to you. When that time expires, you either must drop the FEHB coverage, continue for a period of time or convert to an individual policy.

There is also a Temporary Continuation of Coverage (TCC), known as COBRA, which allows you to carry your coverage for 18 months. You must, however, pay your cost, the agency cost and the 2% administrative fee, totaling 102%.

There are so many changes that have taken place around Federal Employee Health Benefits (FEHB) that individuals who find there are circumstances that might prevent them from transporting FEHB into retirement, now have a number of choices to secure health coverage.

Military or Uniformed Services retirees may elect to cancel their FEHB during open season and opt for ChampVA Tricare or Tricare-For-Life These plans cover Medicare’s coinsurance, deductible and prescription drugs very much like the FEHB plan.

Be sure to check to see what your plan covers and if it allows transporting FEHB, opting always to choose the plan that offers the best benefit to you and your family.

P. S. Always Remember to Share What You Know.

You can always learn more about how FEHB and Medicare work together

About FEHB (Transporting your FEHB)

/by Dianna TafazoliCan I Take My FEHB into Retirement?

Federal employees represent the largest workforce in the world. They also have some of the best benefits on the market with very competitive rates. The federal workforce is so large making it easy for the federal government, acting as representative agent, to negotiate rates that work in the best interest of the federal workforce and their families. Buying in large quantities can drive down costs making the rate for premiums paid by employees for health insurance some of the most competitive you will find.

Federal employees represent the largest workforce in the world. They also have some of the best benefits on the market with very competitive rates. The federal workforce is so large making it easy for the federal government, acting as representative agent, to negotiate rates that work in the best interest of the federal workforce and their families. Buying in large quantities can drive down costs making the rate for premiums paid by employees for health insurance some of the most competitive you will find.

The Federal Employees Health Benefit program (FEHB) is open to all employees who wish to participate. Employees can choose from a number of different health plans that fit their personal and family needs. As federal employees you get to take your health insurance into retirement if you have met the requirement of being enrolled in FEHB five years or from the earliest opportunity to enroll prior to retirement.

Although, as a retiree you get to enjoy the same low premium benefits in retirement, instead of paying those premiums bi-weekly, they will be deducted once per month from your Annuity. You also have the same opportunity to participate in open season just as you did while working.

It does not matter how often you change plans, as long as you meet the five year or first opportunity to enroll requirement, you can transport your FEHB into retirement.

Social Security is also a key component for eligible Federal and Postal employees

Postal employees can access their FEHB accounts HERE

How do your Medicare elections fit with your FEHB elections?

P.S. Always Remember to Share What You Know.