www.liteblue.usps.gov

LiteBlue Program: Log On 3

/by Dianna TafazoliThe LiteBlue Program

More information on the LiteBlue program and continued from;

Log On To LiteBlue

Log On To LiteBlue – Continue 1

LiteBlue ‘My Benefits’ also house additional benefits information and solutions for Postal employees. In addition to an explanation of benefits, LiteBlue offers a Monthly Planning Calendar that contains pay periods and pay dates and holidays. The LiteBlue calendar is designed to help Postal employees track their plans and things to do via a monthly planning calendar. Postal employment opportunities are also advertised via LiteBlue.

The comprehensive communications dynamic offerd through LiteBlue continues with eReassignment, allowing Postal employees to apply for reassignment in other districts where availability exists. Health Care Providers are also listed giving Postal workers access to their health plan providers with the ability to search and compare health care plans and review health plans on a state-by-state basis.

Below are a listing of other benefits and their explanation under the My Benefits section of LiteBlue:

Thrift Savings Plan (TSP) detailing account information, fund investment elections and publications.

• TSP.gov Account Access

• TSP Fund Rates of Return

• TSP Calculators

• TSP Forms and Publications

• TSP Information

Contribution election through PostalEASE

• Sign Up/Change TSP

• TSP Catch-Up Contributions

The benefits offered to Postal Employees through LiteBlue not only provide security in building a life their families can depend on, but extend into retirement with proper planning. All the information is placed in one convenient location so that planning for your retirement future is made easy. Let LiteBlue help you retire well.

P. S. Always Remember to Share What You Know.

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

LiteBlue Program: Log On 2

/by Dianna TafazoliContinued from Log On To the LiteBlue Program

Logging on to the LiteBlue program brings you into contact with My Benefits. Under the LiteBlue program ‘My Benefits’ tab Postal employees can access and understand all the benefits offered to Postal employees. Again, family members can learn right along aside the employee about benefits and how they work now and in retirement.

Logging on to the LiteBlue program brings you into contact with My Benefits. Under the LiteBlue program ‘My Benefits’ tab Postal employees can access and understand all the benefits offered to Postal employees. Again, family members can learn right along aside the employee about benefits and how they work now and in retirement.

Through LiteBlue My Benefits – Benefits Management addresses a whole plethora of benefits options including forms, health benefits (FEHB), life insurance (FEGLI), retirement programs (TSP.gov) and other topics that are critical in career development and retirement planning. Review the list below to familiarize yourself with all the information My Benefits has to offer that impact you and your family.

The LiteBlue Program Benefits Management

• Beneficiary Forms

• Federal Employees Health Benefits (FEHB) Information

• FEHB PostalEASE

• Federal Insurance Programs

• Life Insurance – FEGLI

• Employee Labor Relations Manual

• Retirement Programs

This is a most important section of what the Postal Service’s next generation in employee communications has to offer. Everything that really impacts how an employee will plan to live in his or her work life and in retirement is compacted into Benefits Management. Employees and their spouses and family members have the opportunity to plan at a glance.

Knowing how benefits work now and in your retirement future is what will give you the comfort and security of knowing that your plans are working for your retirement future.

P. S. Always Remember to Share What You Know.

Read More at;

Log On To LiteBlue – Continued 2

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

LiteBlue program: Log On

/by Dianna TafazoliLog On to the LiteBlue Program

What I find fascinating about the LiteBlue program is that it is not only an easy and fast way of communicating and staying connected for Postal employees but for family member as well. Sometimes what is offered to an employee as part of the benefits package can be thoroughly confusing and the LiteBlue program certainly helps the postal employee gain some clarity. So many questions and sometimes what you are looking for simply escapes your consciousness. You turn the next page and find what you thought should be right before your eyes is not there.

What I find fascinating about the LiteBlue program is that it is not only an easy and fast way of communicating and staying connected for Postal employees but for family member as well. Sometimes what is offered to an employee as part of the benefits package can be thoroughly confusing and the LiteBlue program certainly helps the postal employee gain some clarity. So many questions and sometimes what you are looking for simply escapes your consciousness. You turn the next page and find what you thought should be right before your eyes is not there.

It might even be that you didn’t really understand what LiteBlue category the item fell under that you were looking for in the first place. LiteBlue takes all the worry away and makes it simple and easy for Postal employees to find the information they are seeking. Through LiteBlue, the information is right at their fingertips.

If you are looking to see how your money is working for you and your family and you need to know more about what is available, the LiteBlue program has a category called MY MONEY. You will be able to access programs and see how they fit into your planning process for career development and retirement planning. Using LiteBlue.usps.gov you can gain access to programs such as:

Money Management

• Commuter Program

• OPM Voluntary Contributions

• Credit Union

• Combined Federal Campaign

• Flexible Spending Account (FSA)

• Retirement Plan

Payroll

• Allotments/Payroll

• Federal W4

• eTravel Net to Bank

• Savings Bonds

Employee Resources where postal employees can help each other

• Employee Assistance Program

• Postal Employee Relief Fund

We are going to discuss other advantages LiteBlue has to offer to Postal Workers in additional posts on Log On To LiteBlue or the Self-Service Portal (ssp www.usps.gov).

P. S. Always Remember to Share What You Know.

Log On To LiteBlue – Continued 1

Log On To LiteBlue – Continued 2

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

USPS LiteBlue: Stay Connected With LiteBlue

/by Dianna TafazoliStaying Connected with USPS LiteBlue

The United States Postal Service has one of the most efficient ways to stay connected with its employees through USPS Liteblue. It is fast and packed with the kind of information employees need as they plan their careers with the Postal Service.

The United States Postal Service has one of the most efficient ways to stay connected with its employees through USPS Liteblue. It is fast and packed with the kind of information employees need as they plan their careers with the Postal Service.

USPS LiteBlue houses the most important dynamic that a communications and information system can have. It allows employees of the Postal Service to provide feedback on what they would like to see as part of the benefits and provisions offered to them.

LiteBlue has a plethora of information about career development opportunities, revenue and service performance something many employees may not feel falls on their plates. The Postal Service is somewhat different from many areas of the Federal Government, they sale services that every American benefits from. We buy stamps to mail letters and other pieces of information. Although, automation is around and many have gravitated towards electronic mail, the services of the Post Office are still very relevant.

I enjoy the cards my friends and family send to me through the U.S. Postal Service. It is a special feeling to have someone take the time to purchase a card, address it and get it to the post office to be mailed. It is a part of America’s history. Postal employees are well served to look at the revenue and service performance of the Postal Service. LiteBlue also introduces products and recognition among so many other topics that can be accessed by Postal employees.

LiteBlue is a dynamic communications piece that allows Postal Employees to stay connected 24 hours a day. Postal Employees can access their benefits profile. They can view their accounts and make changes to their benefits during open season through a secure portal PostalEASE via LiteBlue.

Postal employees and all Federal Employees should visit relevant information sites often to make sure they are getting the information so critical to capturing all the career development opportunities available and how to begin planning early for a retirement future that is secure and safe.

P. S. Always Remember to Share What You Know

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

How To Bid Assignments / Routes on USPS LiteBlue

/by Admin

How to Bid Assignments and Routes on USPS LiteBlue

The LiteBlue Route / Bid Assignments Process:

The postal employee’s request or ‘bid’ for a posting is submitted to HRSSC the employee’s district rural analyst. The district will be the recipient of all correspondence from HRSSC regarding the bid, which is then forwarded to the rural unit.

The LiteBlue bidding process is, now, entirely automated, from the creation of the route posting to the award (which is given by seniority) and then ultimately to the necessary personnel actions. HRSSC relies upon the local office to review all documents, for accuracy and omissions, prior to any action being taken.

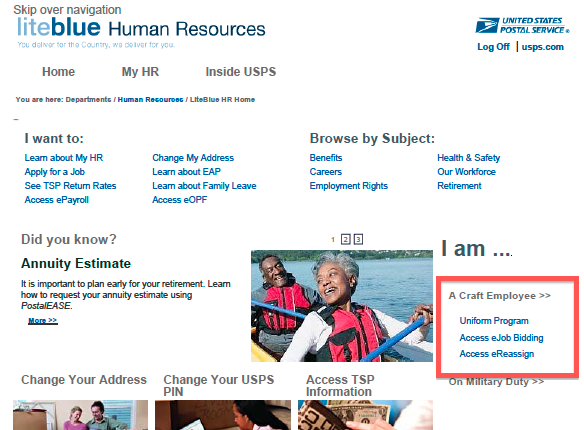

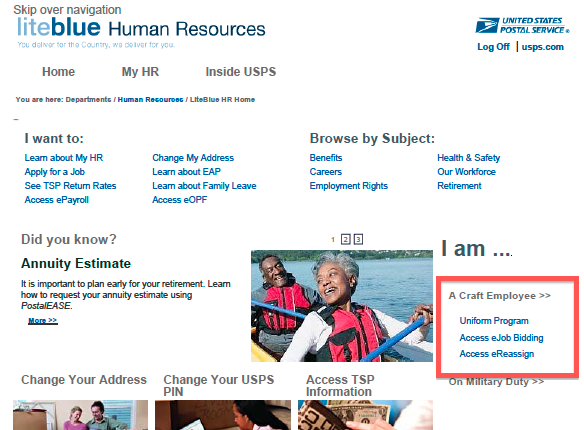

To bid on a posted assignment / route through the USPS LiteBlue website you will need your employee ID and PIN.

Necessary Steps:

1) Visit LiteBlue (www.liteblue.usps.gov) and enter PIN and Employee ID Number where indicated.

2) Click on “My HR” button along the top row.

3) In the right column under the “I Am” section select “A Craft Employee”

This will take you to the USPS LiteBlue bidding page

4) Click ‘Enter Job Bids”

5) Select the “Posting Number” that you would like to bid.

If you are bidding more than one assignment you should indicate your 1st, 2nd and 3rd choice, etc.

Enter your preference in the ‘Choice’ column.

All job bidding through the USPS today is done through LiteBlue or by telephone. The system, which is available 24/7 is called ‘eJobBidding.’ The automated is user friendly and provides instructions to help the user navigate the site and bidding process.

Contact us for more information:

*Using this form will add you to the Psretirement newsletter.

Related LiteBlue Articles

What Postal employees need to do on LiteBlue before retirement

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

USPS LiteBlue – Change of Address for Postal Employees

/by AdminChange of Address Through USPS LiteBlue

Making sure you maintain up-to-date contact information with your employer is incredibly important. For Postal Employees updating this information can take place 24 hours a day 7 days a week through USPS LiteBlue (www.liteblue.usps.com). In addition to your address, Postal employees may also be able to update their phone numbers and emergency contacts through the USPS LiteBlue website.

You will need to have your Employee ID and USPS PIN to access USPS LiteBlue. Once within the site – visit the “Employee Resources” section of the site and select “Change of Address.” Your current information should appear including your Addres, Telephone Number, Emergency Contact, etc.

To update your own information, select the “Edit” button and follow the prompts. Make sure you save any changes and confirm the changes you made are correct and saved within the system before you leave the site.

You can also change your mailing address by mail.

Send the P.S Form 1216, (USPS Change of Address form) to the address below:

HRSSC / COMPESATION & BENEFITS

PO BOX 970400

GREENSBORO, N.C

27497-0400, USA

By Phone

- Call HRSSC phone number (877) 477-3273

- Follow the prompts to be able speaking to someone that would assist you.

LiteBlue – How To Receive A Copy of My Postal Pay Stub

/by AdminIf you are a Postal employee you can easily find a copy of your Postal Service Pay Stub through LiteBlue (www.liteblue.usps.gov)

For the past 40 pay periods (about 20 months) your pay stubs are stored in ePayroll through LiteBlue.

Instructions for ePayroll;

- Visit the LiteBlue

- Enter your USPS employee ID and PIN

- Click the “Log On” button.

- Go to the “Employee Application” carousel

- Choose “ePayroll” from the list of applications.

- Select the “Pay Date” you are in search of

- Your Pay stub show become visible in a separate window.

- In the upper left corner of the window, click the “Print This Page”

Hints and Tips;

1) The PIN you use for PostalEASE is the same PIN you will use to access your Pay stub.

2) You can also access ePayroll through an Internal company computer.

USPS LiteBlue: Access to More Than Just Your Earnings Statement

/by AdminePAYROLL is another www.LiteBlue.usps.gov feature available to you through USPS LiteBlue ‘MY HR.’

“Employee apps” such as “My HR” have been available for several years now through LiteBlue — your HR website on USPS LiteBlue. Among your self-service Employee apps is ePayroll, which is available to nearly all USPS employees (rural delivery employees are not included) who wish to use direct deposit.

The USPS LiteBlue ePayroll app is available to USPS employees 24 hours a day giving you immediate access to your earning statements. Employees can review their earning statements for up to 40 consecutive previous pay periods. (Don’t forget that your USPS LiteBlue access is removed once you separate from service).

Take the STAPLES® Survey – let your voice be heard.

Earnings statements on LiteBlue ePayroll is available the employee once new records are processed. The LiteBlue ePayroll statements provide more detail than traditional printed statements on processed allotments, benefit deductions, withholdings and leave balances. In addition LiteBlue ePayroll also provides the user with online guides so employees can better understand their earnings statements and all of the information contained within them.

“Go Green” with ePayroll

Employees who wish can also store their records electronically on their computers without the need to print out the statements themselves.

How to Access ePayroll (you have 3 ways):

· Go to www.LiteBlue.usps.gov

o Select the Employee Apps ‘carousel’ at the center of the home page.

· On LiteBlue;

o Select the My HR tab and then the “Find Employee Apps” section.

· On LiteBlue;

o Select the employee apps button near the bottom of the ‘My HR’ pages.

What can you do on LiteBlue?

Payroll:

Allotment and Net-to-Bank selections

e-Travel net-to-bank options

Make changes to your Federal W-4

Add, cancel or change your Savings Bond options

View up to 15 years of earnings W-2

Benefits:

Use PostalEase

Change your FEHB options

Enroll, change or cancel your Thrift Savings Plan contributions

You can only change, enroll or cancel your Thrift Savings Plan through LiteBlue. To make Thrift Savings Plan fund transfers, request a Thrift Savings Plan Loan or withdrawal and also view periodic Thrift Savings Plan statements please access your TSP.gov account directly.

Add, change or cancel your Thrift Savings Plan Catch-up contributions

Enroll in a Flexible Spending Account (FSA)

Request an Annual Leave Exchange

NOTE: These selections are typically made during Open Season – You should verify the dates for Open Season.

USPS employees will need their Employee ID and USPS PIN number in order to access LiteBlue. For further information on how to use LiteBlue click HERE.

Other LiteBlue Related Pages

What Is LiteBlue?

PostalEase / LiteBlue

What Postal Employees Should Do On LiteBlue Before Retirement

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

USPS LiteBlue: New LiteBlue PIN

/by AdminUSPS LiteBlue

As of April 28, 2014, Postal employees will be required to use a new password to access USPS LiteBlue / PostalEase and other self-service web applications like eCareer and ePayroll. This move will take place through the usage of a Self-Service Profile (SSP) application (www.ssp.usps.gov) which will be used by employees to create and manage their self-service password, email address, security challenge questions, and 4-digit Personal PIN.

As of April 28, 2014, Postal employees will be required to use a new password to access USPS LiteBlue / PostalEase and other self-service web applications like eCareer and ePayroll. This move will take place through the usage of a Self-Service Profile (SSP) application (www.ssp.usps.gov) which will be used by employees to create and manage their self-service password, email address, security challenge questions, and 4-digit Personal PIN.

“The change to a self-service password (on the LiteBlue system) is necessary to protect and secure employee information,” said Corporate Information Security Officer Chuck McGann. The hope is that by moving to a stronger password, USPS employee data will be more secure and that the LiteBlue online USPS system will able to help protect employee’s personal information better.

If you are a Postal employee you can easily find a copy of your Postal Service Pay Stub through LiteBlue (www.liteblue.usps.gov)

Take the STAPLES® Survey – let your voice be heard.

Employees can access the SSP Password application;

A) Through the Internet at www.liteblue.usps.gov & www.ssp.usps.gov

B) Through the USPS Intranet, via the USPS LiteBlue Page on the Human Resources website, and

C) Through an Employee Self-Service USPS LiteBlue kiosk (available at some facilities).

LiteBlue: How To Use USPS LiteBlue

/by Admin

On LiteBlue.usps.gov, enter “I Am A Craft Employee”

How to use LiteBlue

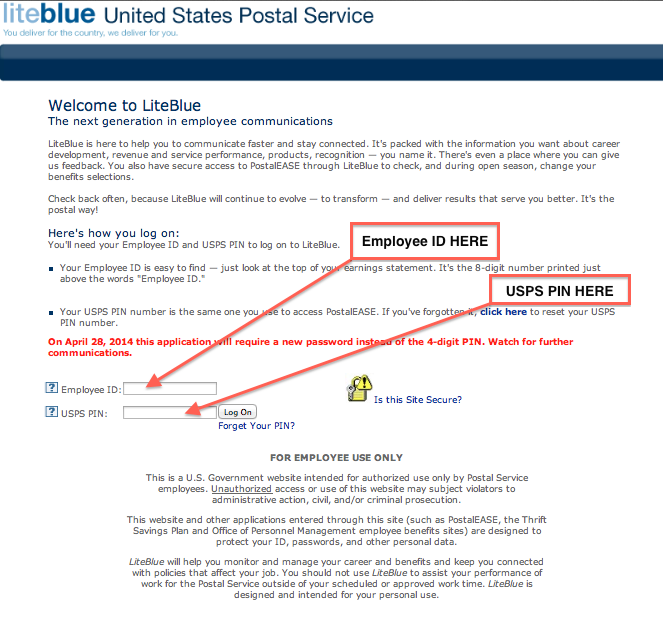

To use LiteBlue and view your information, visit the website (LiteBlue.usps.gov). You will find the site by clicking HERE. The site is maintained by the USPS as part of the United States Postal Service employee service extranet.

You will need to fill in the required fields on the login screen (see below for visual instructions). You will also need several forms of identification in order to access USPS.

What You Will Need to access your account;

Your USPS employee ID number.

You can find your USPS Employee ID Number on any one of your earnings statements if you do not already know it.

Your USPS PIN number, which was given to you for access to PostalEASE.

Stay up to date on your USPS career development;

By navigating the menus on USPS site you will be able to stay up to date on your career and access other important information.

You can find information about your;

USPS Service performance,

Your Postal Employee benefits package and

USPS revenue.

Leave feedback on USPS.

If you have suggestions or need additional information, select the feedback option.

[my_chatbot]

Contact us for more information

Related LiteBlue Articles

How To Bid Assignments / Routes On LiteBlue

What Postal employees need to do before retirement

What Postal Employees Should Do Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications

You can use PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms

The information on this page and website, including links, images, and references are made available to you for information purposes only. Public Sector Retirement, LLC (PSRetirement.com) is NOT affiliated with the USPS or any other Government Agency. PSRetirement.com makes these links available but does not guarantee the information or administer these unrelated sites. PSRetirement.com also cannot access your private employee or retirement information and we cannot reset your PIN numbers or provide you with Tax information. Please review the Terms of Use for clarification and please contact Shared Services or your Post Master for further information.

BEDB – Other Details You Might Need To Know

/by Dianna TafazoliAdditional BEDB Information

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

Many persons receiving survivor or BEDB death benefits will make address changes, bank account changes and other changes after submitting the application. If you happen to change your bank account before you receive payment, keep the old account open until you are assured that the payment has been deposited into the new account.

When you are fully acclimated into the system and begun receiving annuity payments, you can conduct much of your business online, including making any changes you deem necessary. You will receive a password to utilize the services of the online system once your payments begin.

Whether you choose to receive your BEDB payments via direct deposit or the direct express debit card, you will receive all other information relevant to you at the mailing address on file with the Office of Personnel Management.

If your mailing address changes before the processing of your application is completed by OPM and you have not received your claim number you should write to the Office of Personnel Management giving your name, date of birth, social security number and the same for the deceased federal employee. If you have received your claim number you can communicate with OPM via telephone of write to register a change of address.

When addressing any BEDB questions and/or concerns to OPM be sure to always use your claim number on all correspondence.

P. S. Always Remember to Share What You Know.

More information might be available to you on FEGLI and survivor annuity payments

Surviving spouses and family members of postal employees should visit LiteBlue for additional information

Receiving Your BEDB and Survivor Annuity Payment

/by Dianna TafazoliReceiving your BEDB Payment

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Many individuals who came of age when a lot of the automation we take for granted today was not in existence, have some reservations about BEDB direct deposit and taking care of their financial affairs online. The Department of Treasury through which federal benefits are paid requires all federal benefits be made by electronic means.

Believe it or not, there are still some individuals who do not have bank accounts; they simply choose to handle their business otherwise where they find the most comfort and security. The government recognizes this concern and for individuals who do not have bank accounts, payments can be made through a Direct Express Debit Card. The BEDB annuity payment is automatically deposited to the card on the date you would otherwise receive your annuity payment and is immediately available for your use.

There are some benefits you cannot receive by direct deposit or the express debit card and they are the Basic Employee Death Benefit and the survivor annuity payment if your permanent address where you would ordinarily receive payments is outside of the United States in countries where the automated programs are not available.

You must notify the Office of Personnel Management as to how you wish to receive your BEDB payments by completing Section 1 of SF 3104 – Application for Death Benefits. You can also send the Direct Deposit sign-up form (SF 1199A) to OPM’s Retirement Operations Branch – Boyers, Pennsylvania – P. O. Box 440 – 16017-0440. You and your bank must complete the form. You can also fax the information to OPM. Visit the OPM website for a current fax number.

Open communication is the path to a future you are prepared to meet.

P.S. Always Remember to Share What You Know.

The deceased may have had additional life insurance through FEGLI.

Postal employee families are encourages to visit LiteBlue for information

LiteBlue: What Postal employees should do on LiteBlue Before Retirement

/by Admin

What Postal employees should do on

LiteBlue.usps.gov

Before Retirement and Separation

Your information that is currently available on LiteBlue will be gone after your separation. Once you leave service LiteBlue will no longer be available to you, so be sure to download the following list from LiteBlue so you can maintain your own records.

Your information that is currently available on LiteBlue will be gone after your separation. Once you leave service LiteBlue will no longer be available to you, so be sure to download the following list from LiteBlue so you can maintain your own records.

Before You Retire Access LiteBlue and Retain the Following Records

- Your entire eOPF,

- earnings statements in ePayroll,

- W-2s in PostalEASE and

- anything else you may want in the future

Periodically, postal employees will face challenges with OPM after retirement and will need these documents. All of this can be found through your LiteBlue Account and should be downloaded and saved before your retirement.

To download your entire eOPF;

- Click on “Access Personnel Folder Now!” and

- Choose “Print Entire eOPF.”

- On the LiteBlue account, (Once the .PDF is generated you will be able to find it in a small box at the lower left corner of your LiteBlue screen. You will want to save the .PDF to your computer and possibly save a printed copy for your records.

If eligible for an incentive payment;

Download PS Form 3077

- Give your employing office the address where you want your incentive payment to be sent.

- The incentive agreement stipulates that eligible employees will complete PS Form 3077, Request to Forward Salary Check, and submit it to their employing office.

- In the absence of a PS Form 3077, incentive payments will be mailed to the location where you last worked.

o Download the PS Form 3077 Here

Update your address through LiteBlue. In the event you have difficulty with your LiteBlue account access, as some have, this would be another reason to submit PS Form 3077.

Other LiteBlue Related Pages

What Is LiteBlue?

PostalEase

What Postal Employees Should Do Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Postal and Open Season

Postal Retirement – Preparing the Workforce

/by Dianna TafazoliPreparing for Postal Retirement

The Postal Service has several programs designed to secure upward mobility for its workforce. There is an Advanced Leadership Program, an Associate Supervision Program, a National Center for Employee Development and a Managerial Leadership Program and an online platform to access your benefit information and make certain elections, LiteBlue.usps.gov. All of these programs are designed to help the Postal Employees grow in their career and prepare for retirement.

The Postal Service has several programs designed to secure upward mobility for its workforce. There is an Advanced Leadership Program, an Associate Supervision Program, a National Center for Employee Development and a Managerial Leadership Program and an online platform to access your benefit information and make certain elections, LiteBlue.usps.gov. All of these programs are designed to help the Postal Employees grow in their career and prepare for retirement.

Each program, from LiteBlue to the Thrift Savings Plan, is designed to help and to develop a workforce of excellence, equipped with the knowledge, skills and abilities to implement operations required by high-tech equipment and practices necessary to carry-out the complex work of the Postal Service and to retire comfortably.

In order to reach the Postal Service’s large and multi-jurisdictional workforce, the service uses a plethora of e-learning tools and other technology to train its employees. The Postal Service’s training profile is designed to recruit and train program leaders and managers up to the executive level of operations.

An unfortunate reality, however, is the fact that the USPS has chosen to remove most HR functions from local Post Office with the creation of the Shared Services. The need for direction, therefore, on HR and Retirement related questions often falls to potentially untrained individuals at your Station and word of mouth recommendations. The need for financial professionals has never been more important to the Postal employees and soon to be retirees because of the demographic shift and the aging of the workforce, along with the ever increasing complexity in TSP funds and recommendations, FEGLI comparisons and ways for these employees to protect their lifestyle and financial well-being in retirement.

If you’re a Postal employee and have questions on your benefits and postal retirement, PSRetirement.com can provide you with introductions to local FERS, CSRS, TSP and FEGLI experts and may be able to facilitate a free Benefit Analysis for you and members of your office or Local Union looking for direction or help. Regardless of where you turn, make sure that you are getting the information you rely upon from a competent expert in your complex benefit and retirement options.

Information on the unique benefits for Postal Employees is also important to understand

Other Postal Retirement and LiteBlue Related Pages

What Postal Employees Should Do On LiteBlue Before Retirement

Changing Your LiteBlue / PostalEase Password Through ssp.USPS.gov

eRetire for Postal Employees – Retirement Applications on LiteBlue

Use LiteBlue to Manage your FEHB

You can use LiteBlue and PostalEase to manage your Allotments

Requesting Duplicate Postal Employee W-2 Forms Using LiteBlue

An Economically Changing World

/by Dianna Tafazoli The world is changing. As Federal and Postal employees we face more economic challenges today than the majority of the current workforce has ever witnessed. The hardships of the Great Depression, we either read about in textbooks or heard stories from parents and grandparents, but hardly a reality for baby boomers and beyond.

The world is changing. As Federal and Postal employees we face more economic challenges today than the majority of the current workforce has ever witnessed. The hardships of the Great Depression, we either read about in textbooks or heard stories from parents and grandparents, but hardly a reality for baby boomers and beyond.

Over the past several years, the reality of our finances and the turbulence of a global economy is a constant conversation at the average Federal and Postal employee’s families dinner tables. Yet, our responsibility, regardless if we are CSRS or FERS, to do what is necessary to face a retirement future with readiness, still remains. I remember parents saying, “Save for a rainy day.” The economic uncertainty of our times requires that we save for a tsunami. The cost of maintaining our standard of living is much higher today than it was for our parents.

In addition, economically, conditions have created differing and varying levels of responsibility for Federal and Postal retirees. Retirement incomes are increasingly being shared to support other family members, including adult children who are either unemployed or under-employed. Providing support to family members is what we do as Americans until they can get on their feet.

Because our plates are fuller than ever before in recent times, planning for a long life after retirement must be approached with care and a deliberate commitment to live well below our means. We can no longer economically live at our means and certainly not above our means, but below them in order to have a cushion of economic longevity. Remember, economically, the goal is to have your resources outlast you.

The technical aspects of the federal and postal employees’ retirement system from FEHB, Medicare, to FEGLI and your TSP are difficult to understand and much more difficult to master. There are such a vast number of technical pieces of the federal retirement system it seems to justify the use and consultation of both your HR office or a qualified retirement benefit expert.

Use PSRetirement.com’s easy access for more information on your TSP Account and Login information.

P. S. Always Remember to Share What You Know.

Additional Information on FEHB

/by Dianna TafazoliStrong Consideration Should be Given to Holding On to your FEHB in retirement.

Many Federal and Postal retirees will have a critical decision to make about their Health Benefits moving into retirement and whether or not they should transport their FEHB coverage. If your spouse has a health care plan outside of government and you have FEHB, in conjunction with you potential Medicare elections, you should careful analysis should be exercised to determine what fits best into your plan to retire well.

Many Federal and Postal retirees will have a critical decision to make about their Health Benefits moving into retirement and whether or not they should transport their FEHB coverage. If your spouse has a health care plan outside of government and you have FEHB, in conjunction with you potential Medicare elections, you should careful analysis should be exercised to determine what fits best into your plan to retire well.

There will never be a plan or plans that pay 200% coverage, but having your FEHB and Medicare upon reaching the qualifying age of 65 could guarantee your health care security. Medicare will only pay about 80% of your health care expenses and FEHB will cover the rest. However, once you become qualified for Medicare, and you are retired, Medicare will become the primary coverage with FEHB being secondary in most instances.

If you are still working when you reach age 65 and qualify for Medicare, your FEHB will remain the primary. It should also be noted that there are many services that standard Medicare does not cover and some, even, that FEHB does not cover. A careful examination of what services are covered under both FEHB and Medicare is critical to determine the best health benefit fit for you and your family.

When you become eligible for Medicare, it is very wise to look at the important benefits your FEHB offers, particularly when compared to Medicare’s prescription drug coverage. The drug prescription coverage offered via FEHB is second to none. Therefore, even when you become eligible for Medicare, don’t forget to consider holding on to your FEHB so that retiring well will be a part of your plan to live well in retirement.

P. S. Always Remember to Share What You Know.

Military – Tricare and FEHB

/by Dianna TafazoliTricare and FEHB

Federal and Postal employees must meet the 5 year enrollment requirement in order to take my FEHB into retirement. However, if you don’t have the required time, you may use your Military Tricare time to qualify for FEHB.

Federal and Postal employees must meet the 5 year enrollment requirement in order to take my FEHB into retirement. However, if you don’t have the required time, you may use your Military Tricare time to qualify for FEHB.

Military personnel enrolled in Tricare (regulated by the Department of Defense (DOD) is a health care program that serves Uniformed Service members, retirees and their families around the world) are able to count that Tricare time towards the required five year provision for FEHB as long as they are enrolled in an FEHB covered health plan at retirement.

As a federal employee you do not have to worry about filling out an application to keep your health benefits when your retire. When your retirement becomes effective, your coverage will automatically transfer to the Office of Personnel Management (OPM) where they will process your retirement papers and take care of you as a retiree. Your agency will no longer be responsible for you.

If, however, you decide that you don’t want to take your FEHB into retirement, you will need to include in your retirement package a fully completed SF 2809 (Benefits Registration Form) cancelling your coverage.

FEHB access for Postal employees HERE

P. S. Always Remember to Share What You Know.

About FEHB (Transporting your FEHB)

/by Dianna TafazoliCan I Take My FEHB into Retirement?

Federal employees represent the largest workforce in the world. They also have some of the best benefits on the market with very competitive rates. The federal workforce is so large making it easy for the federal government, acting as representative agent, to negotiate rates that work in the best interest of the federal workforce and their families. Buying in large quantities can drive down costs making the rate for premiums paid by employees for health insurance some of the most competitive you will find.

Federal employees represent the largest workforce in the world. They also have some of the best benefits on the market with very competitive rates. The federal workforce is so large making it easy for the federal government, acting as representative agent, to negotiate rates that work in the best interest of the federal workforce and their families. Buying in large quantities can drive down costs making the rate for premiums paid by employees for health insurance some of the most competitive you will find.

The Federal Employees Health Benefit program (FEHB) is open to all employees who wish to participate. Employees can choose from a number of different health plans that fit their personal and family needs. As federal employees you get to take your health insurance into retirement if you have met the requirement of being enrolled in FEHB five years or from the earliest opportunity to enroll prior to retirement.

Although, as a retiree you get to enjoy the same low premium benefits in retirement, instead of paying those premiums bi-weekly, they will be deducted once per month from your Annuity. You also have the same opportunity to participate in open season just as you did while working.

It does not matter how often you change plans, as long as you meet the five year or first opportunity to enroll requirement, you can transport your FEHB into retirement.

Social Security is also a key component for eligible Federal and Postal employees

Postal employees can access their FEHB accounts HERE

How do your Medicare elections fit with your FEHB elections?

P.S. Always Remember to Share What You Know.

Enrollment for Medicare – Part B

/by Dianna TafazoliEnrollment for Medicare Part B is based on numerous factors.

You have the option to delay enrollment in Medicare Part B. One instance would be if you did not take Medicare Part B at the point of eligibility, for instance, because you or your spouse were still working and covered under an employee sponsored group health plan.

You have the option to delay enrollment in Medicare Part B. One instance would be if you did not take Medicare Part B at the point of eligibility, for instance, because you or your spouse were still working and covered under an employee sponsored group health plan.

The Medicare enrollment period generally runs annually from January 1 – March 31. Coverage begins on July 1 of the year of enrollment. Remember you may have to pay a premium surcharge for late enrollment unless you are covered by a group health plan like the Federal Employees Health Benefits Plan (FEHB) based on current enrollment when you are first able to receive Medicare.

If you are disabled, your coverage can be as a result of your own or a family member’s current employment.

P. S. Always Remember to Share What You Know.

Medicare and FEHB can be confusing. You may wish to continue your reading here.

For Postal Employees access your LiteBlue account here

Qualifying for Medicare

/by Dianna TafazoliQualifying for Medicare requires more than just reaching Age 65

Age 65 does not automatically qualify you to receive Medicare. Age 65 is one of the eligibility criteria, but does not automatically qualify you to receive the benefit. Qualifying for Medicare is not as simple as many people believe. You must not only meet the age requirement, but either you or your spouse must have worked at least 10 years in a Medicare-covered employment in order to receive what is commonly referred to as free-Medicare-Part A (Hospital Insurance).

Age 65 does not automatically qualify you to receive Medicare. Age 65 is one of the eligibility criteria, but does not automatically qualify you to receive the benefit. Qualifying for Medicare is not as simple as many people believe. You must not only meet the age requirement, but either you or your spouse must have worked at least 10 years in a Medicare-covered employment in order to receive what is commonly referred to as free-Medicare-Part A (Hospital Insurance).

Working for 10 years under a Medicare covered employment provides you with the 40 credits, previously called quarters, needed to qualify. On average, an employee earns 4 credits per year of employment, accumulating 40 credits in 10 years.

As of January 1, 1983, if you were a federal employee, you automatically qualify for Medicare. Even if you do not qualify for Part A (premium free), the Social Security Administration might be able to direct you as to how you can obtain Part A of Medicare. Make sure to explore every option to ensure you will be qualifying for Medicare.

P. S. Always Remember To Share What You Know.

For information on FEHB and Medicare please see the attached